Question: Implement a class TaxBill. A TaxBill is defined by the individual's marital status and taxable income. Your job is to determine the amount of tax

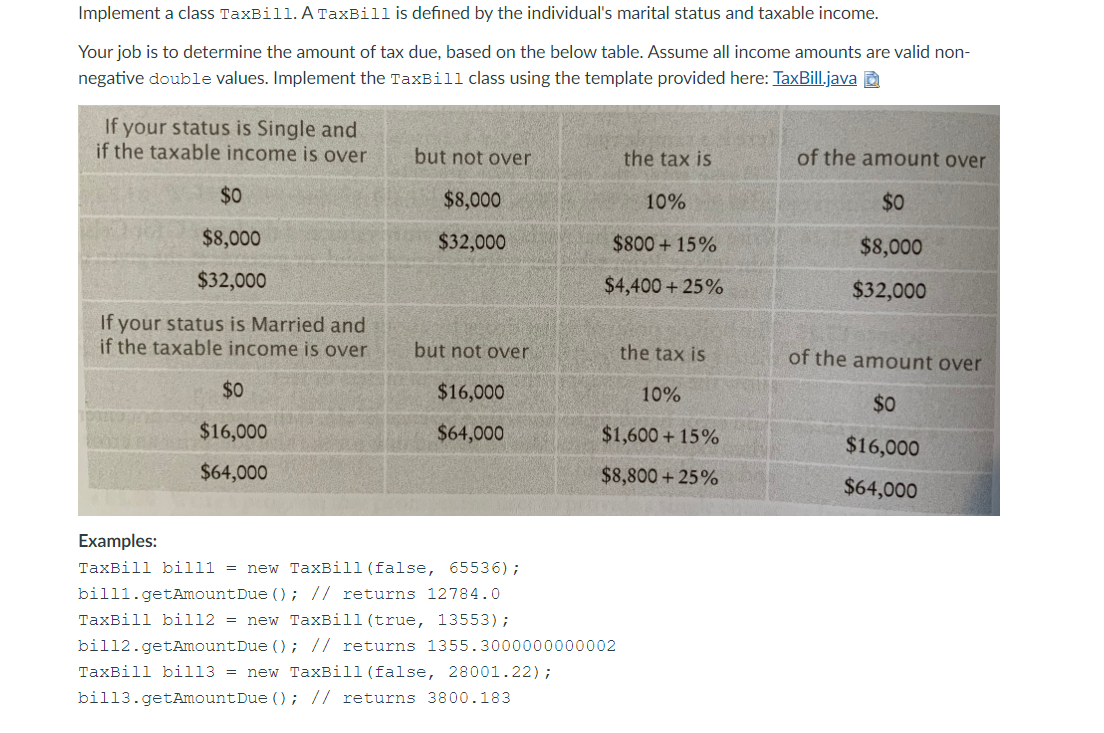

Implement a class TaxBill. A TaxBill is defined by the individual's marital status and taxable income. Your job is to determine the amount of tax due, based on the below table. Assume all income amounts are valid non- negative double values. Implement the TaxBill class using the template provided here: TaxBill.java a If your status is Single and if the taxable income is over but not over the tax is of the amount over $0 $8,000 10% $0 $8,000 $32,000 $800 + 15% $8,000 $32,000 $4,400 + 25% $32,000 If your status is Married and if the taxable income is over but not over the tax is of the amount over $0 $16,000 10% $0 $16,000 $64,000 $1,600 + 15% $64,000 $8,800 + 25% $16,000 $64,000 Examples: TaxBill billl = new TaxBill(false, 65536); billi.getAmount Due (); // returns 12784.0 TaxBill bill2 = new TaxBill(true, 13553); bil12.getAmount Due (); // returns 1355.3000000000002 TaxBill bill3 = new TaxBill(false, 28001.22); bil13.getAmountDue (); // returns 3800.183

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts