Question: Implied distribution Equity Derivatives and Volatility notes (page 21) Recall that our first approach to option-pricing models used prices of call-butterfly spreads to extract an

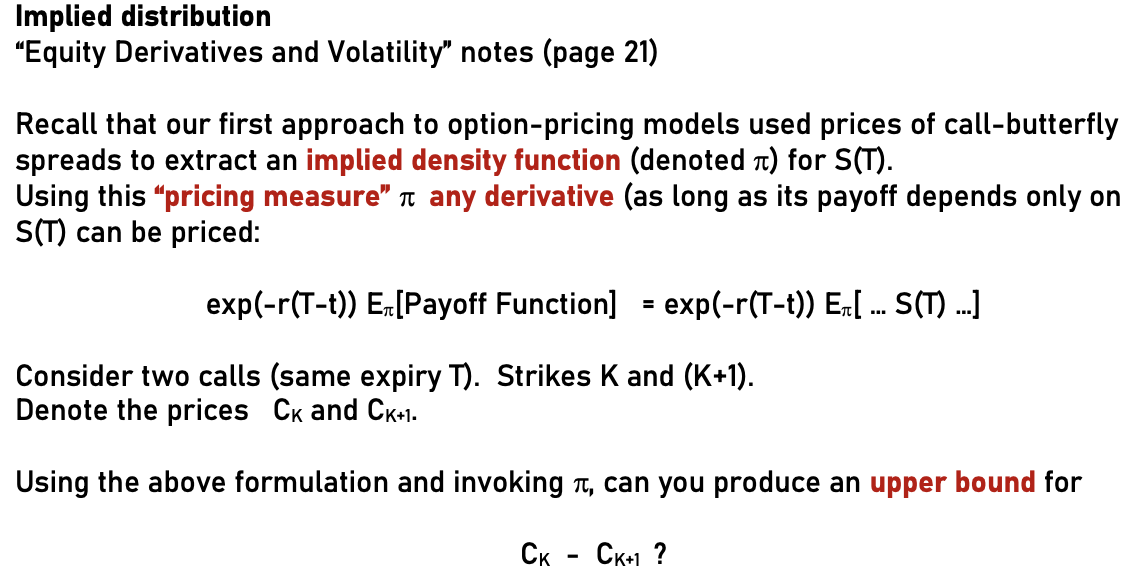

Implied distribution Equity Derivatives and Volatility" notes (page 21) Recall that our first approach to option-pricing models used prices of call-butterfly spreads to extract an implied density function (denoted a) for S(T). Using this "pricing measure a any derivative (as long as its payoff depends only on S(T) can be priced: exp(-r(T-t)) Ex[Payoff Function] = exp(-r(T-t)) En[ ... S(T) ...] Consider two calls (same expiry T). Strikes K and (K+1). Denote the prices Ck and CK+1. Using the above formulation and invoking r, can you produce an upper bound for Ck - CK+1? Implied distribution Equity Derivatives and Volatility" notes (page 21) Recall that our first approach to option-pricing models used prices of call-butterfly spreads to extract an implied density function (denoted a) for S(T). Using this "pricing measure a any derivative (as long as its payoff depends only on S(T) can be priced: exp(-r(T-t)) Ex[Payoff Function] = exp(-r(T-t)) En[ ... S(T) ...] Consider two calls (same expiry T). Strikes K and (K+1). Denote the prices Ck and CK+1. Using the above formulation and invoking r, can you produce an upper bound for Ck - CK+1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts