Question: Important note: Try to solve the manual method especially with regard to Net Present Value (NPV) and Profitability Ratio (IP). Show steps And the solution

Important note: Try to solve the manual method especially with regard to Net Present Value (NPV) and Profitability Ratio (IP). Show steps And the solution method. It is possible that it can be able to it may be able to verify it. AND I NEED ANSWER BY ELECTRONIC WAY NOT ON PAPER

Important note: Try to solve the manual method especially with regard to Net Present Value (NPV) and Profitability Ratio (IP). Show steps And the solution method. It is possible that it can be able to it may be able to verify it. AND I NEED ANSWER BY ELECTRONIC WAY NOT ON PAPER

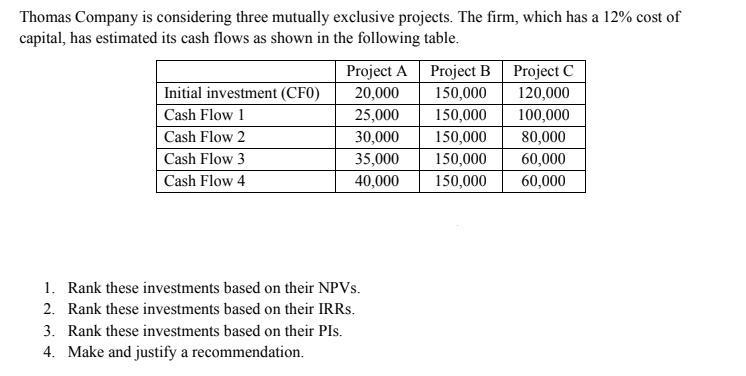

Thomas Company is considering three mutually exclusive projects. The firm, which has a 12% cost of capital, has estimated its cash flows as shown in the following table. Project A Project B Project C Initial investment (CFO) 20,000 150,000 120,000 Cash Flow 1 25,000 150,000 100,000 Cash Flow 2 30,000 150,000 80,000 Cash Flow 3 35,000 150,000 60,000 Cash Flow 4 40,000 150,000 60,000 1. Rank these investments based on their NPVs. 2. Rank these investments based on their IRRs. 3. Rank these investments based on their Pls. 4. Make and justify a recommendation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts