Question: ****IMPORTANT**** Please see 2 hints highlighted 'Biannual rate' and '2 less outstanding'. Provide the formula for excel not just hard amount. A 6.50 percent coupon

****IMPORTANT****

Please see 2 hints highlighted 'Biannual rate' and '2 less outstanding'.

Provide the formula for excel not just hard amount.

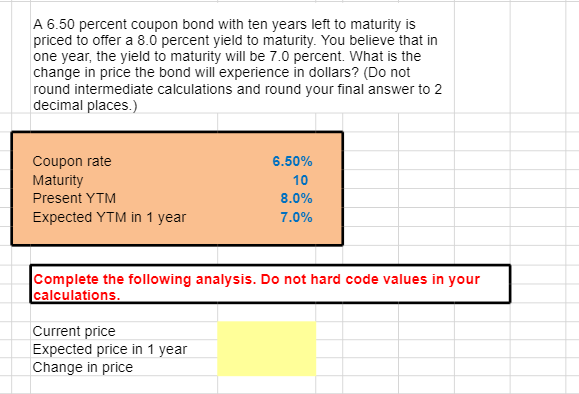

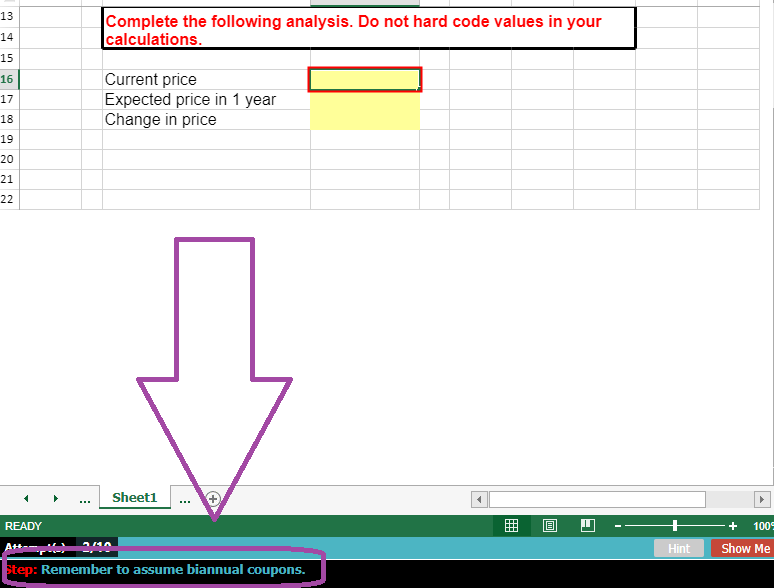

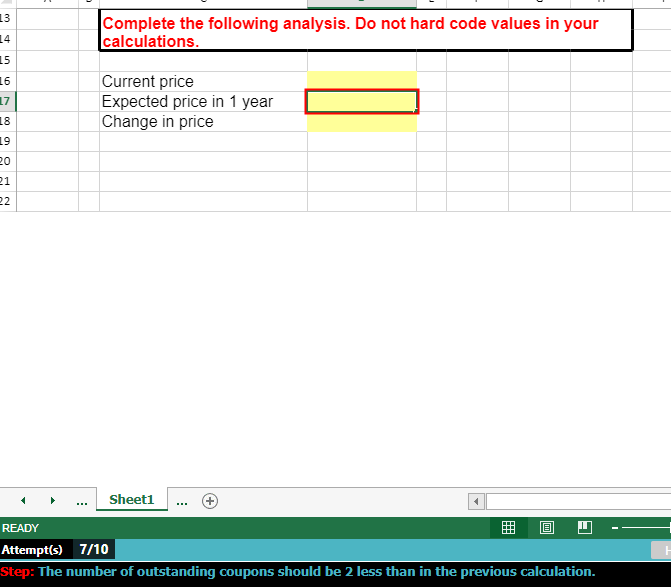

A 6.50 percent coupon bond with ten years left to maturity is priced to offer a 8.0 percent yield to maturity. You believe that in one year, the yield to maturity will be 7.0 percent. What is the change in price the bond will experience in dollars? (Do not round intermediate calculations and round your final answer to decimal places.) Coupon rate Maturity Present YTM Expected YTM in 1 year 6.50% 10 8.0% 7.0% Complete the following analysis. Do not hard code values in your calculations. Current price Expected price in 1 year Change in price 13 14 Complete the following analysis. Do not hard code values in your calculations. 15 16 17 Current price Expected price in 1 year Change in price 18 19 20 21 22 Sheet1 READY + 100% AH- Hint Show Me Step: Remember to assume biannual coupons. 13 Complete the following analysis. Do not hard code values in your calculations. 14 15 16 17 18 19 20 21 22 Current price Expected price in 1 year Change in price Sheet1 READY Attempt(s) 7/10 Step: The number of outstanding coupons should be 2 less than in the previous calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts