Question: Important: . Please type the number without the comma sign. Keep 2 decimal places. Financial analysts want to use corporate valuation model to value Weston

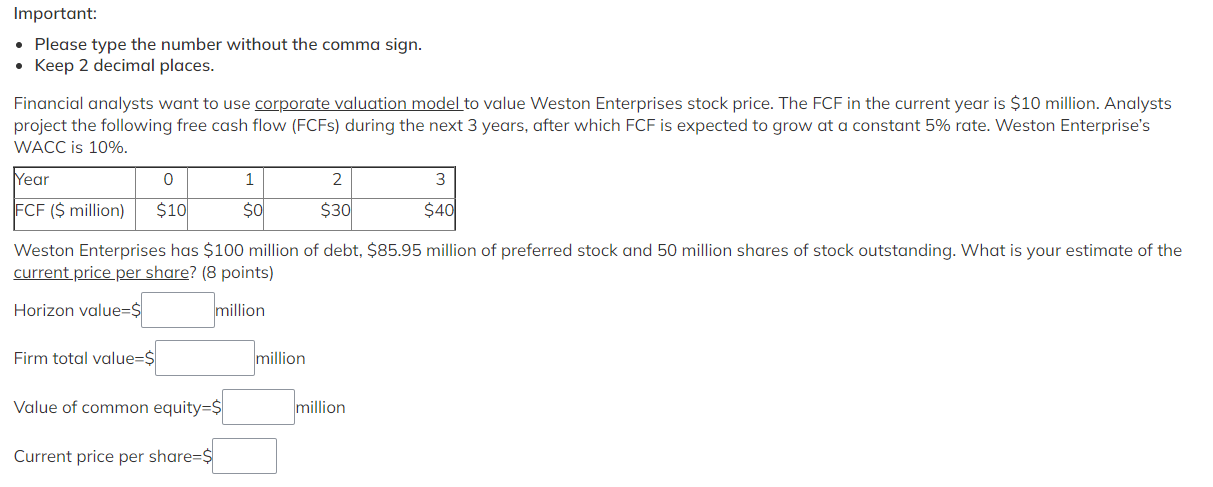

Important: . Please type the number without the comma sign. Keep 2 decimal places. Financial analysts want to use corporate valuation model to value Weston Enterprises stock price. The FCF in the current year is $10 million. Analysts project the following free cash flow (FCFS) during the next 3 years, after which FCF is expected to grow at a constant 5% rate. Weston Enterprise's WACC is 10%. Year 0 1 2. 3 FCF ($ million) $10 $0 $30 $40 Weston Enterprises has $100 million of debt, $85.95 million of preferred stock and 50 million shares of stock outstanding. What is your estimate of the current price per share? (8 points) Horizon value=$ million Firm total value=$ million Value of common equity=$ million Current price per share=$

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts