Question: IMPORTANT Questions 1 & 2 ask for cash flows only, no present values. They are a critical part of the problem, but since the problem

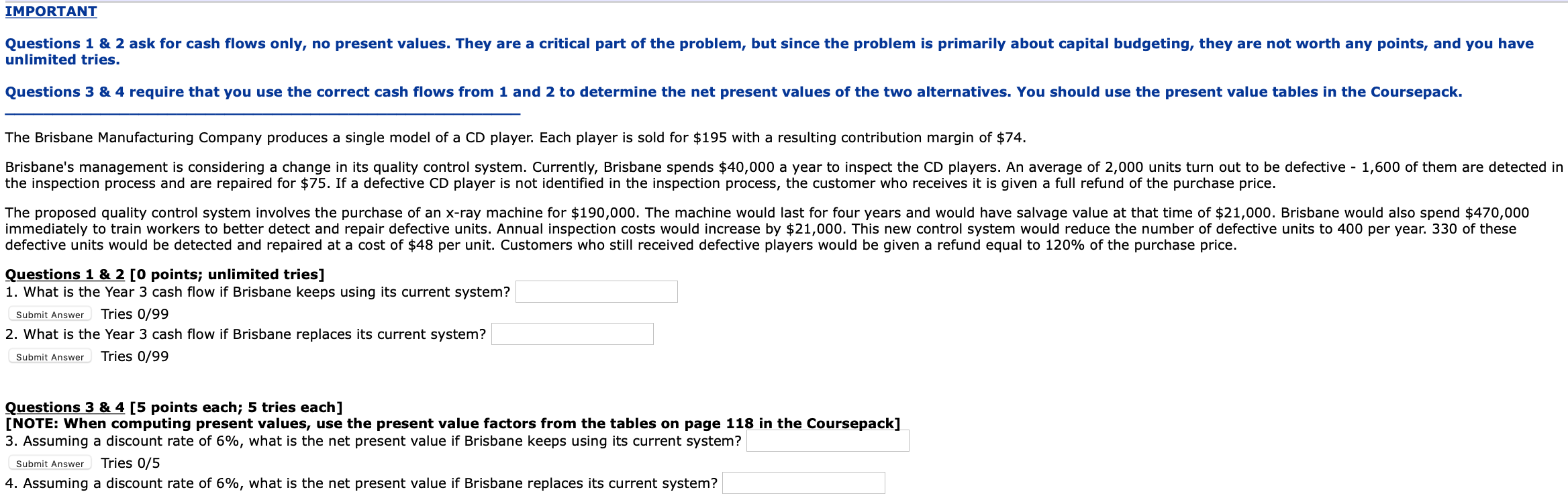

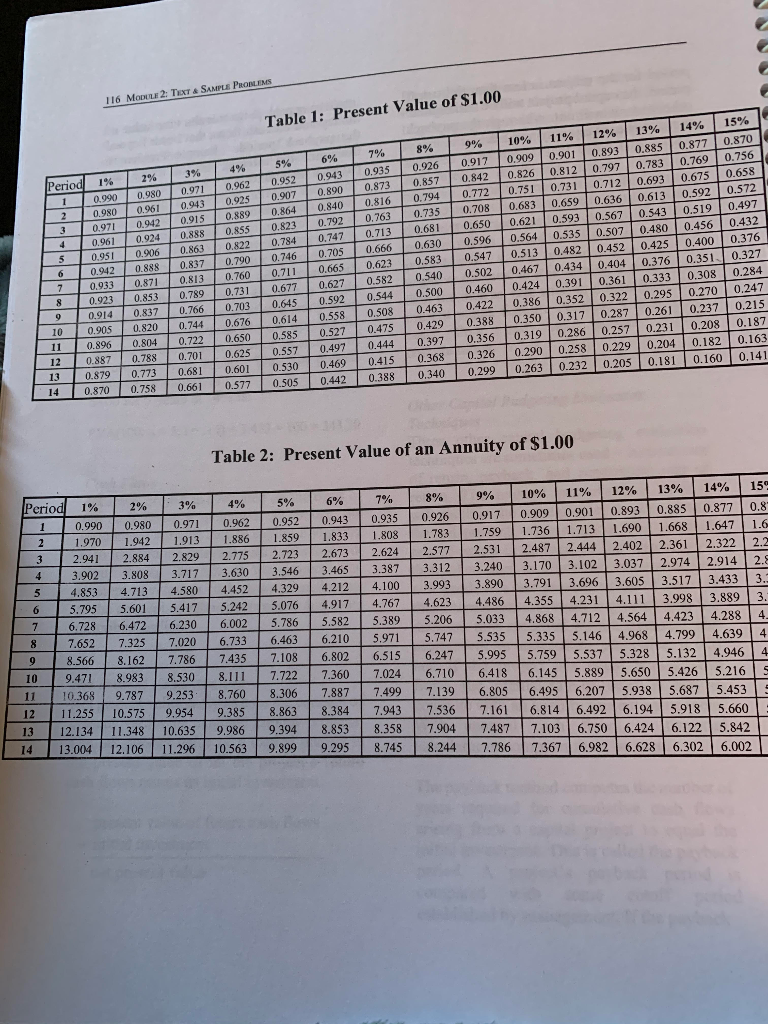

IMPORTANT Questions 1 & 2 ask for cash flows only, no present values. They are a critical part of the problem, but since the problem is primarily about capital budgeting, they are not worth any points, and you have unlimited tries. Questions 3 & 4 require that you use the correct cash flows from 1 and 2 to determine the net present values of the two alternatives. You should use the present value tables in the Coursepack. The Brisbane Manufacturing Company produces a single model of a CD player. Each player is sold for $195 with a resulting contribution margin of $74. Brisbane's management is considering a change in its quality control system. Currently, Brisbane spends $40,000 a year to inspect the CD players. An average of 2,000 units turn out to be defective - 1,600 of them are detected in the inspection process and are repaired for $75. If a defective CD player is not identified in the inspection process, the customer who receives it is given a full refund of the purchase price. The proposed quality control system involves the purchase of an x-ray machine for $190,000. The machine would last for four years and would have salvage value at that time of $21,000. Brisbane would also spend $470,000 immediately to train workers to better detect and repair defective units. Annual inspection costs would increase by $21,000. This new control system would reduce the number of defective units to 400 per year. 330 of these defective units would be detected and repaired at a cost of $48 per unit. Customers who still received defective players would be given a refund equal to 120% of the purchase price. Questions 1 & 2 [O points; unlimited tries] 1. What is the Year 3 cash flow if Brisbane keeps using its current system? Submit Answer Tries 0/99 2. What is the Year 3 cash flow if Brisbane replaces its current system? Submit Answer Tries 0/99 Questions 3 & 4 [5 points each; 5 tries each] [NOTE: When computing present values, use the present value factors from the tables on page 118 in the Coursepack] 3. Assuming a discount rate of 6%, what is the net present value if Brisbane keeps using its current system? Submit Answer Tries 0/5 4. Assuming a discount rate of 6%, what is the net present value if Brisbane replaces its current system? 116 Mon 2: Tixta Smrt Prom Table 1: Present Value of $1.00 perind 1129 13% 14% 5% 6% 7% 0.980 1 0.971 0.990 06 10052 0.962 0.935 0043 0.952 0.943 0.955 0.961 0.90 0.943 | 035 T0002 0.873 0.890 0.971 0.942 0.915 0.889 10.864 0.864 0.840 0.816 0061 098 0.88 0.55 0.821 0.792 0.763 01 000 0.861 0.822 0.784 0.7470.713 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.933 0.871 0.813 0.760 0.711 0.665 0.623 8 0 .923 0.853 0.789 0.731 0,6770 627 0.582 0.914 0.837 0.766 0.703 0.645 0.592 0.544 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 1 0.896 0.804 0722 0.650 5 R 0.527 0.475 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 14 0.870 0.758 0.661 0.577 0 505 0.442 0.388 8% 9% 10% 0.9260.917 0.909 0.8570.842 0.826 0.794 0.772 0.751 0.735 0.708 0.683 0.681 0.650 0.621 0,630 0.596 0.564 0.5830.547 0.513 0.540 0.502 | 0.467 0.500 0.460 0.424 0.463 0.422 0.386 0.429 0.388 0.350 0.397 0.356 0.319 0.368 0.326 0.290 0.340 0.299 0.263 11% 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 12% 13% 14% 15% 0.893 0.885 0.877 0.870 0.797 0.783 0.769 0.756 0.712 0.693 0.675 0.658 0.636 0.613 0.592 0.572 0.567 0.543 0.519 0.497 0.507 0.480 0.456 0.432 0.452 0.425 0.400 0.376 0.404 0.376 0.351.1 0.327 0.361 0.333 0.308 0.284 0.322 0.295 0.270 0.247 0.287 10.261 0237 0215 0.257 0.231 0.208 0.187 0.229 0.204 0.182 0.16 0.205 0.181 0.160 0.14 Table 2: Present Value of an Annuity of $1.00 1% Period 3% 4% 2% 5% 6% 7% 8% 9% 10% 13% 11% 12% 15, 14% 0.943 0.990 0.9800.971 0.952 0.962 0.935 0.9260 0.893 0.885 0.8 .917 0.9090,901 0.877 2 1 1.913 | 1.886 1.859 .970 1.833 1.690 1.942 1.8081.783 1.668 1.759 1.6 1.647 1.7361.713 3 2.9412.884 2.8292.775 2.723 2.6732.624 2.577 2.531 | 2.487 2.444 | 2.402 2.361 | 2.322 | 2.2 4 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3 .240 3.170 3.102 3.037 2.974 | 2.914 2. 5 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.9933.890 3.791 3.696 3.605 3.517 3.433 3. 6 5.795 5.601 5.417 5.2425.0764.917 4.767 4.623 4.4864.355 4.231 4.111 3.9983.889 3. 6.728 6,472 6.230 6.002 5.786 5.582 5.389 5.2065.033 4.8684.712 4.564 4.423 4.2884 7.652 7.3257.020 6.733 6.463 6.210 5.9715.7475.535 5.335 5.146 4.968 | 4.799 4.6394 8.5668.1627.786 7.4357.108 6.802 6.5156.2475.995 5.7595.537 5.328 5.132 4.946 4 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.889 5.650 5.426 5.216 10.368 9.787 9.2538.760 8.306 7.887 7.499 7.1396.8056.4956,207 5.938 5.6875,453 12 11.255 10.575 9.9549.3858.8638.384 7.943 7.5367.1616 .8146.4926.1945.918 5.660 13 12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.750 6.424 6.1225.842 14 13.004 12.106 11.296 10.563 9.899 9.2958.745 8.2447.786 7.3676.982 6.628 6.302 6.002

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts