Question: Important. Show complete computations. Q.# 1. On March 02, 1998 General Dynamics purchased an equipment for $ 20,000. The estimated useful life of the asset

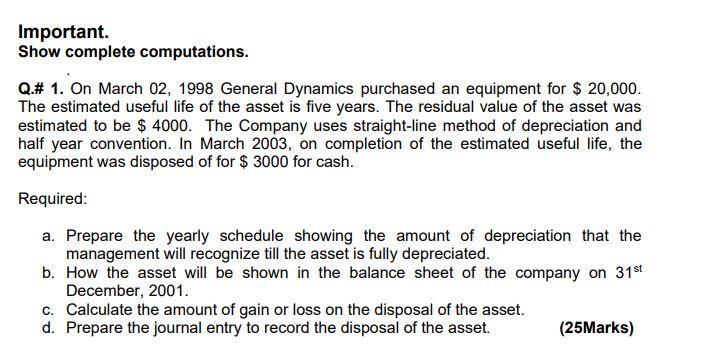

Important. Show complete computations. Q.# 1. On March 02, 1998 General Dynamics purchased an equipment for $ 20,000. The estimated useful life of the asset is five years. The residual value of the asset was estimated to be $ 4000. The Company uses straight-line method of depreciation and half year convention. In March 2003, on completion of the estimated useful life, the equipment was disposed of for $ 3000 for cash. Required: a. Prepare the yearly schedule showing the amount of depreciation that the management will recognize till the asset is fully depreciated. b. How the asset will be shown in the balance sheet of the company on 31st December, 2001. C. Calculate the amount of gain or loss on the disposal of the asset. d. Prepare the journal entry to record the disposal of the asset. (25Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts