Question: IMPORTANT: Submit both the regular Excel worksheet and also the formula sheet In order to display formulas press CTRL+ [the button above the tab button.]

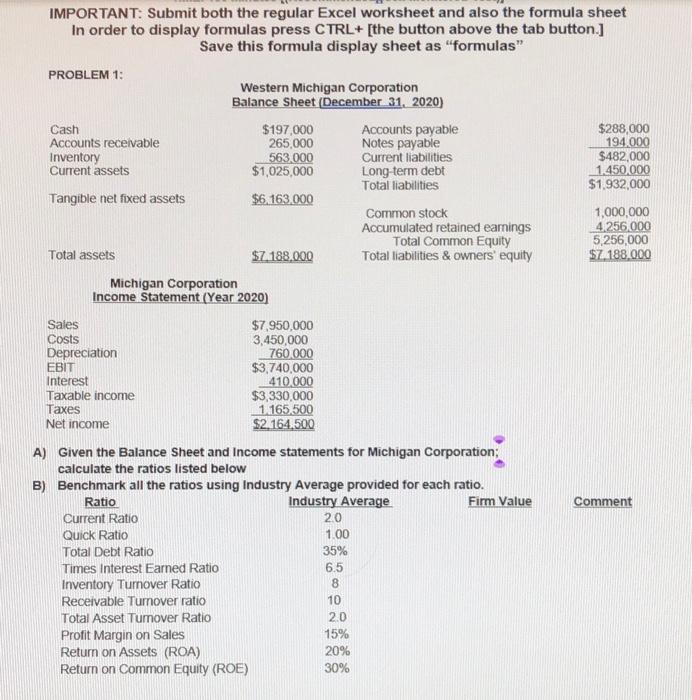

IMPORTANT: Submit both the regular Excel worksheet and also the formula sheet In order to display formulas press CTRL+ [the button above the tab button.] Save this formula display sheet as "formulas" PROBLEM 1: Western Michigan Corporation Balance Sheet (December 31, 2020) Cash Accounts receivable Inventory Current assets $197,000 265,000 563.000 $1,025,000 Accounts payable Notes payable Current liabilities Long-term debt Total liabilities $288,000 194.000 $482,000 1.450,000 $1,932,000 Tangible net fixed assets $6.163.000 Common stock Accumulated retained earings Total Common Equity Total liabilities & owners' equity 1,000,000 4.256.000 5,256,000 $7.188.000 Total assets $7.188.000 Michigan Corporation Income Statement (Year 2020) Sales Costs Depreciation EBIT Interest Taxable income Taxes Net income $7,950,000 3,450,000 760 000 $3,740,000 410.000 $3,330,000 1 165,500 $2.164,500 A) Given the Balance Sheet and Income statements for Michigan Corporation; calculate the ratios listed below Comment B) Benchmark all the ratios using Industry Average provided for each ratio. Ratio Industry Average Firm Value Current Ratio 20 Quick Ratio 1.00 Total Debt Ratio 35% Times Interest Earned Ratio 6.5 Inventory Turnover Ratio 8 Receivable Turnover ratio 10 Total Asset Tumover Ratio 2.0 Profit Margin on Sales 15% Return on Assets (ROA) 20% Return on Common Equity (ROE) 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts