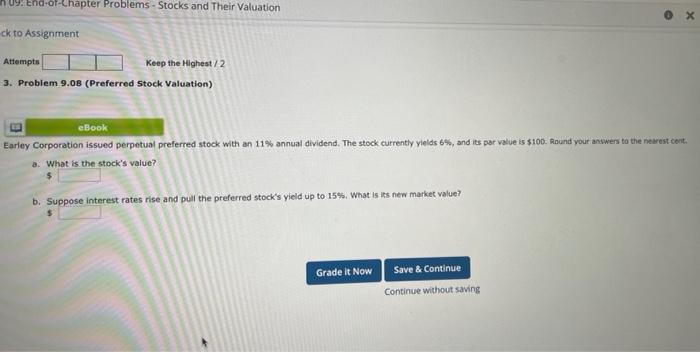

Question: in 09: End-of-Chapter Problems - Stocks and Their Valuation ck to Assignment Attempts Keep the Highest/2 3. Problem 9.08 (Preferred Stock Valuation) eBook Earley Corporation

in 09: End-of-Chapter Problems - Stocks and Their Valuation ck to Assignment Attempts Keep the Highest/2 3. Problem 9.08 (Preferred Stock Valuation) eBook Earley Corporation issued perpetual preferred stock with an 11% annual dividend. The stock currently yields 6%, and its par value is $100. Round your answers to the nearest cent. a. What is the stock's value? b. Suppose interest rates rise and pull the preferred stock's yield up to 15%. What is its new market value? Grade it Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts