Question: IN 125% + 05 E 69 9 View Zoom Add Page Insert Table Chart Text Shape Media Comment Collaborate Format Document Style Image Arrange Page

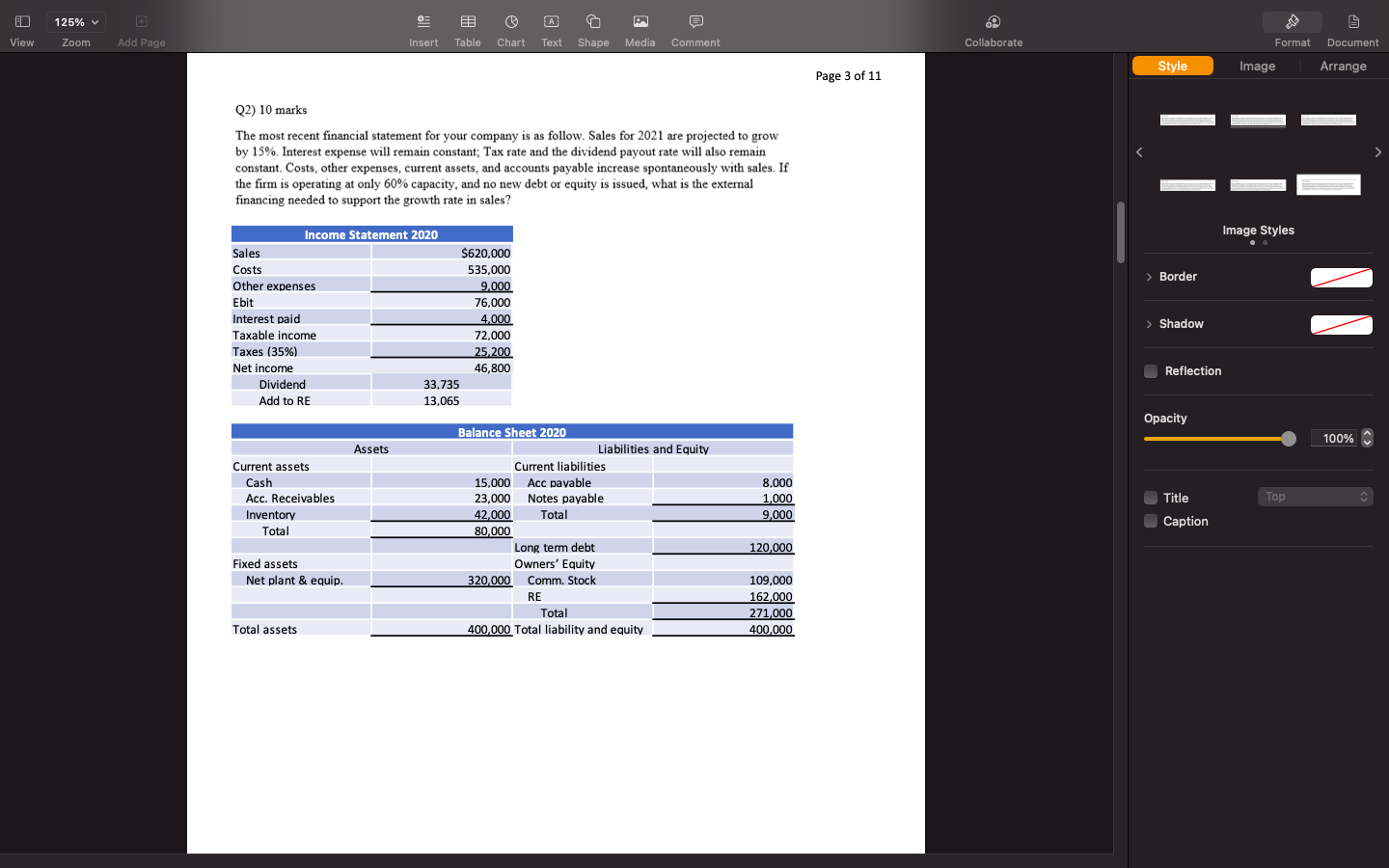

IN 125% + 05 E 69 9 View Zoom Add Page Insert Table Chart Text Shape Media Comment Collaborate Format Document Style Image Arrange Page 3 of 11 Q2) 10 marks The most recent financial statement for your company is as follow. Sales for 2021 are projected to grow by 15%. Interest expense will remain constant; Tax rate and the dividend payout rate will also remain constant. Costs, other expenses, current assets, and accounts payable increase spontaneously with sales. If the firm is operating at only 60% capacity, and no new debt or equity is issued, what is the external financing needed to support the growth rate in sales? Image Styles > Border Income Statement 2020 Sales $620,000 Costs 535.000 Other expenses 9.000 Ebit 76,000 Interest paid 4,000 Taxable income 72.000 Taxes (35%) 25 200 Net income 46,800 Dividend 33,735 Add to RE 13.065 > Shadow Reflection Opacity 100% Assets Current assets Cash 8.000 Top Acc. Receivables Inventory Total 1.000 9,000 Title Caption Balance Sheet 2020 Liabilities and Equity Current liabilities 15.000 Acc payable 23,000 Notes payable 42,000 Total 80,000 Long term debt Owners' Equity 320,000 Comm. Stock RE Total 400,000 Total liability and equity 120,000 Fixed assets Net plant & equip. 109,000 162,000 271,000 400,000 Total assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts