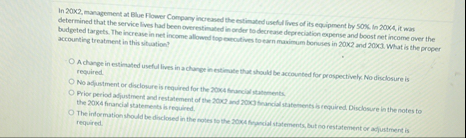

Question: In 2 0 0 2 , management at Blue Flower Company increased the estimated useful lives of its equipment by 5 0 0 % .

In management at Blue Flower Company increased the estimated useful lives of its equipment by In t it was determined that the service lives had been overestimated in onder to decrease depreciation expense and boost ret income over the budgeted targets. The increase in net income allownd top excotives to ewn mumum bonuses in x and xC What is the proper accounting treatment in this sluation?

A change in eatimated useful lives in a change in estimate that should be accounted for prospective ha No disclosure is required.

No adjustment or disclosure is required for the financial statements.

Prier period affustiment and restatement of the and teninglal statements is required. Disclosure in the notes to

the firancial statements is required.

The information should be disclosed in the rotes to the foyancial statements, but no restatement or acfustment is required.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock