Question: In 2 0 1 4 , BB granted an incentive stock option ( ISO ) to Raul to buy 6 , 0 0 0 shares

In BB granted an incentive stock option ISO to Raul to buy shares of BB stock at $ per share for years. At date of grant, BB stock was trading on the AMEX for $ per share. In Raul exercised the option when BBs stock was trading at $ per share. Required: How much income did Raul recognize in and because of the ISO? Compute Rauls basis in the shares. What are the tax consequences of the stock option to BB in and This year, Jordan accepted a Job with BL Incorporated. Jordan Intends to work for only elght years and then start a business. Jordan has two options for accumulating the money needed to start this business:

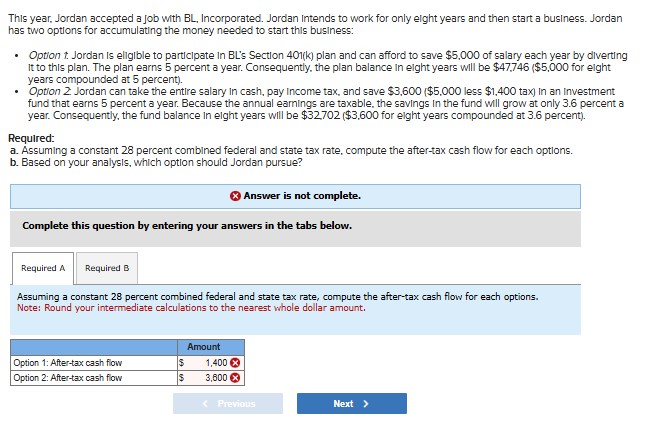

Option t Jordan is eligible to participate in BLs Section k plan and can afford to save $ of salary each year by diverting it to this plan. The plan earns percent a year. Consequently, the plan balance in eight years will be $ $ for eight years compounded at percent

Option Jordan can take the entire salary in cash, pay Income tax, and save $ $ less $ tax in an investment fund that earns percent a year. Because the annual earnings are taxable, the savings in the fund will grow at only percent a year. Consequently, the fund balance in eight years will be $ $ for eight years compounded at percent

Required:

a Assuming a constant percent combined federal and state tax rate, compute the aftertax cash flow for each options.

b Based on your analysis, which option should Jordan pursue?

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Assuming a constant percent combined federal and state tax rate, compute the aftertax cash flow for each options.

Note: Round your intermediate calculations to the nearest whole dollar amount.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock