Question: In 2 0 2 3 , Don and his son purchased real estate for an investment. The price of the property was $ 6 2

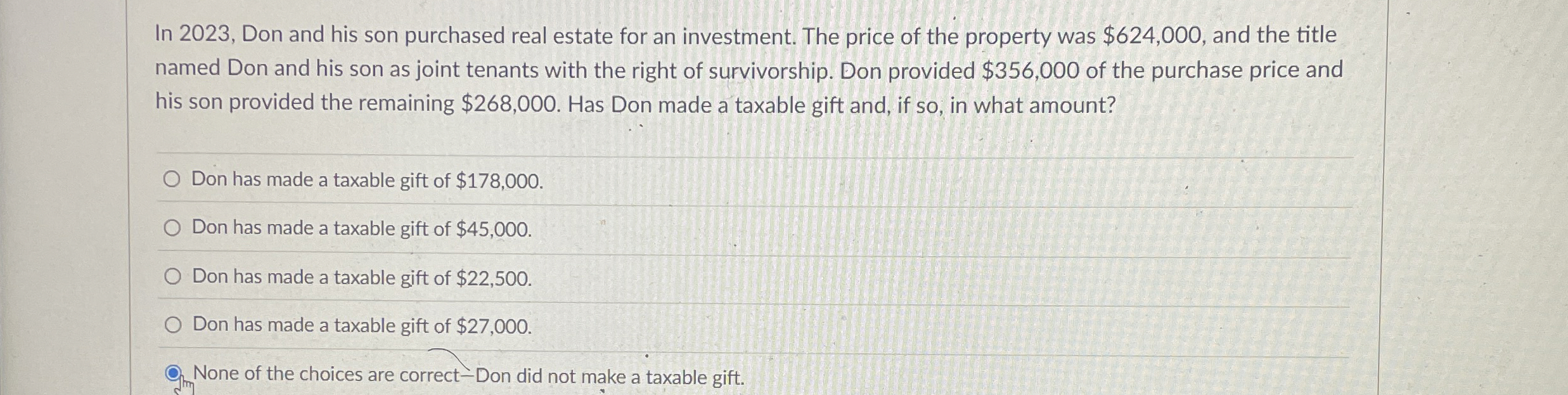

In Don and his son purchased real estate for an investment. The price of the property was $ and the title named Don and his son as joint tenants with the right of survivorship. Don provided $ of the purchase price and his son provided the remaining $ Has Don made a taxable gift and, if so in what amount?

Don has made a taxable gift of $

Don has made a taxable gift of $

Don has made a taxable gift of $

Don has made a taxable gift of $

None of the choices are correctDon did not make a taxable gift.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock