Question: In 2 0 2 3 , Jonathan transferred $ 9 0 , 0 0 0 of cash to a trust for the benefit of Hannah,

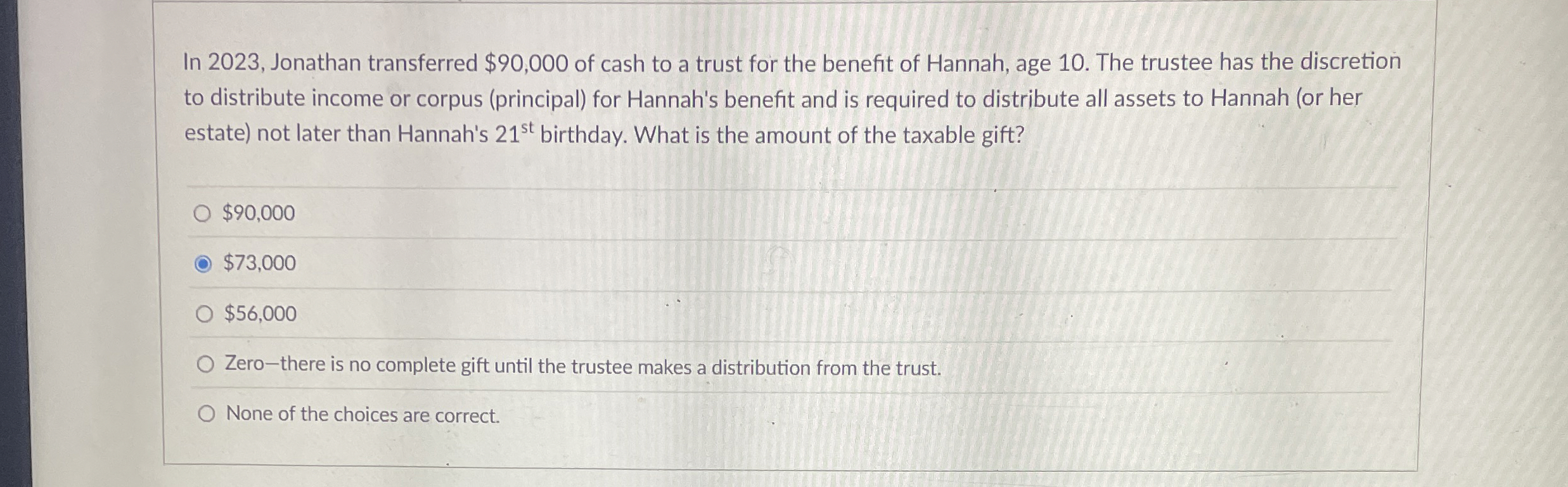

In Jonathan transferred $ of cash to a trust for the benefit of Hannah, age The trustee has the discretion to distribute income or corpus principal for Hannah's benefit and is required to distribute all assets to Hannah or her estate not later than Hannah's birthday. What is the amount of the taxable gift?

$

$

$

Zerothere is no complete gift until the trustee makes a distribution from the trust.

None of the choices are correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock