Question: In 2 0 2 3 , Vaughn Ltd , which follows IFRS, reported accounting income of $ 3 2 8 , 0 0 0 and

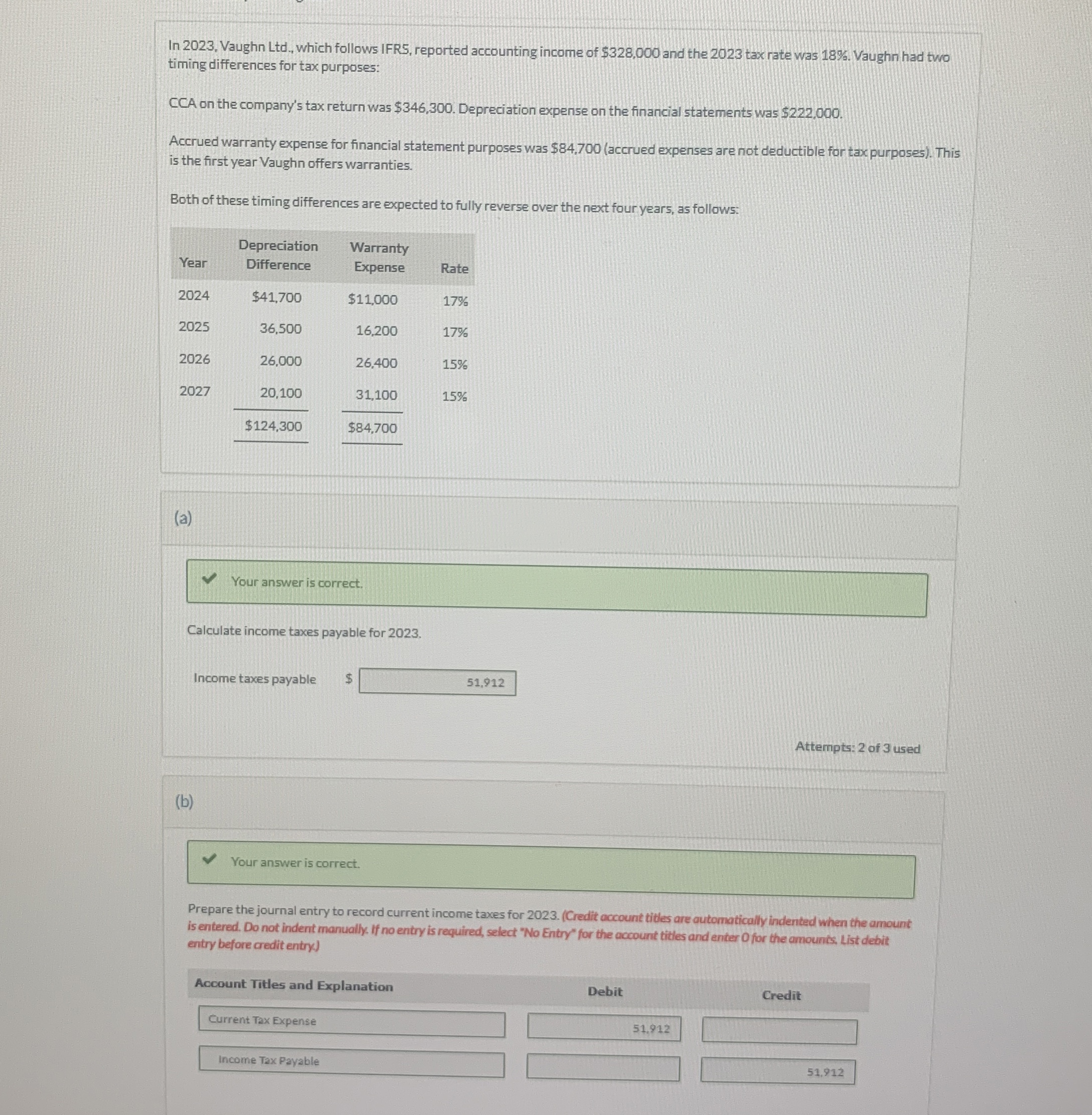

In Vaughn Ltd which follows IFRS, reported accounting income of $ and the tax rate was Vaughn had two timing differences for tax purposes:

CCA on the company's tax return was $ Depreciation expense on the financial statements was $

Accrued warranty expense for financial statement purposes was $accrued expenses are not deductible for taxpurposes This is the first year Vaughn offers warranties.

Both of these timing differences are expected to fully reverse over the next four years, as follows:

tableYeartableDepreciationDifferencetableWarrantyExpenseRate$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock