Question: In 2 0 2 4 , CPS Company changed Its method of valuing Inventory from the FIFO method to the average cost method. At December

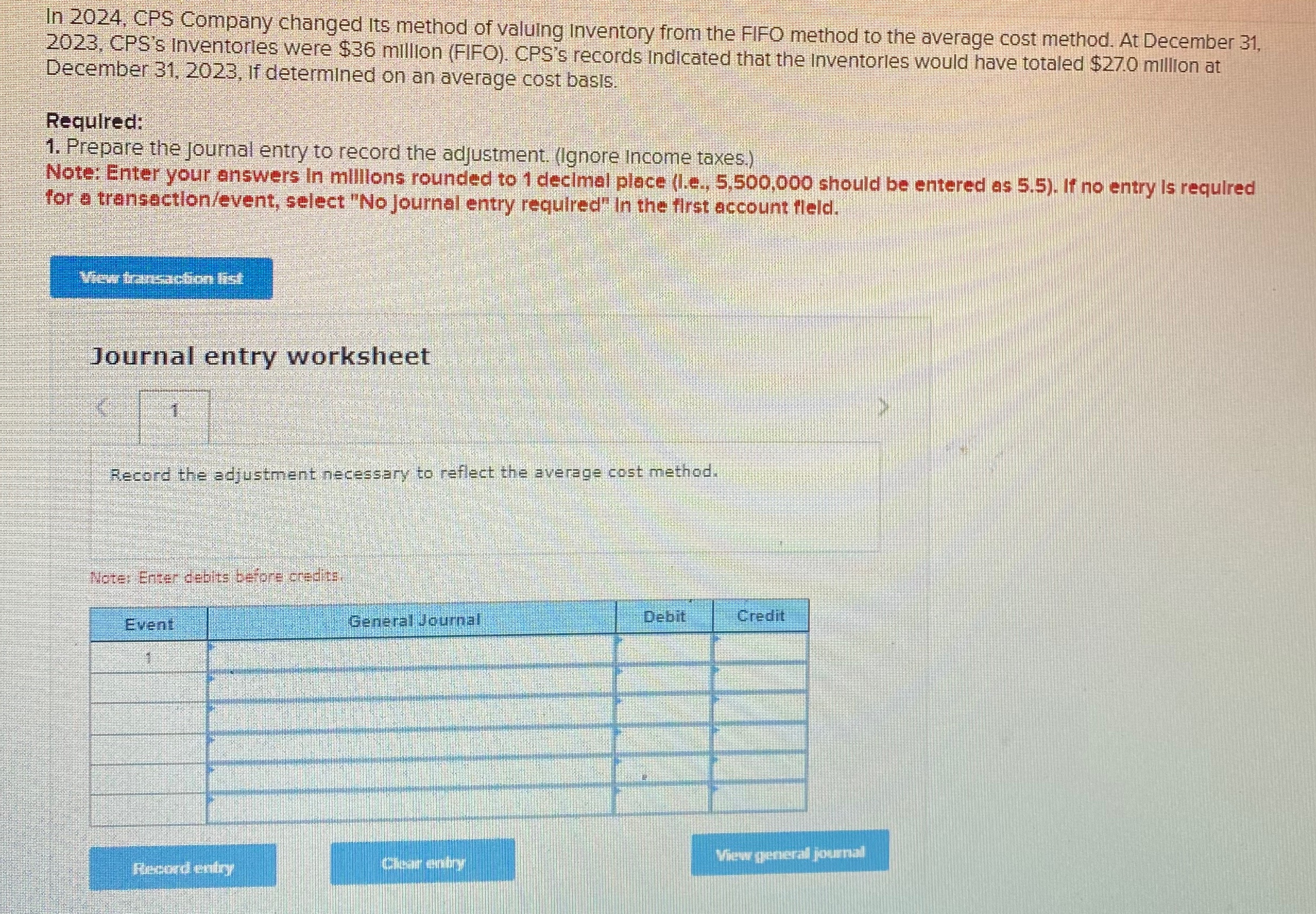

In CPS Company changed Its method of valuing Inventory from the FIFO method to the average cost method. At December CPSs inventorles were $ million FIFO CPSs records indicated that the inventorles would have totaled $million at December If determined on an average cost basis.

Required:

Prepare the journal entry to record the adjustment. Ignore income taxes.

Note: Enter your answers In millons rounded to decimal place Ie should be entered as If no entry is requlred for a transectionevent select No Journal entry required" In the first account fleld.

Journal entry worksheet

Record the adjustment necessary to reflect the average cost method.

Moter Entar actits bupre sedte:

tableEventGeneral Journal,Debit,Credit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock