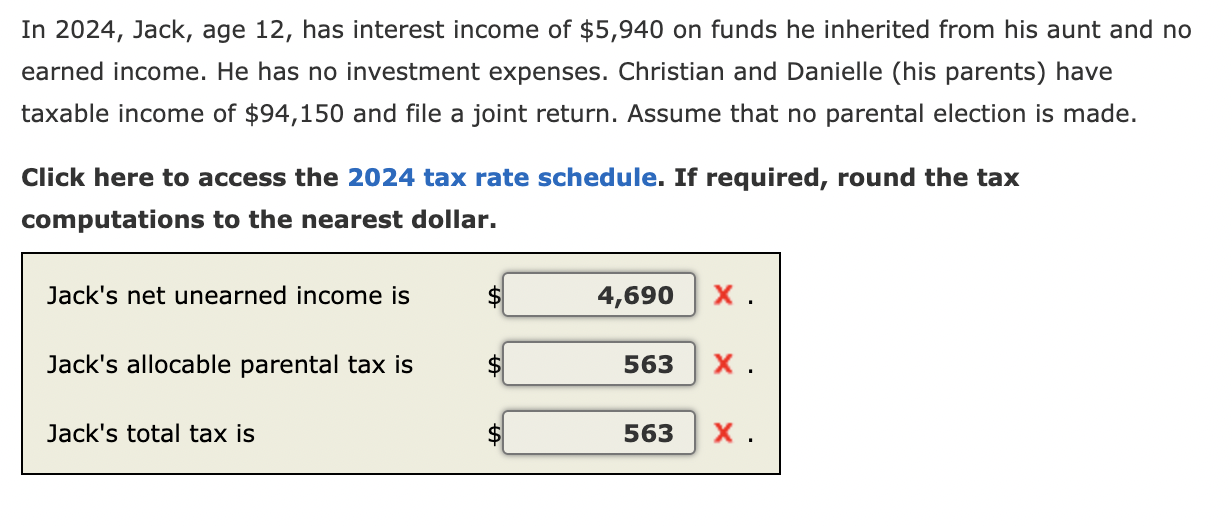

Question: In 2 0 2 4 , Jack, age 1 2 , has interest income of $ 5 , 9 4 0 on funds he inherited

In Jack, age has interest income of $ on funds he inherited from his aunt and no Tax Rate Schedules

tableSingleSchedule XHead of householdSchedule ZtableIf taxableincome is:OvertableBut notoverThe tax is:tableof theamountovertableIf taxableincome is:OvertableBut notoverThe tax is:tableof theamountover$ $ $ $ $ $ $ $intableMarried filing jointly or Qualifying widowerSchedule YMarried filing separatelySchedule YtableIf taxableincome is:OvertableBut notoverThe tax is:tableof theamountovertableIf taxableincome is:OvertableBut notoverThe tax is:tableof theamountover$ $ $ $ $ $ $

earned income. He has no investment expenses. Christian and Danielle his parents have

taxable income of $ and file a joint return. Assume that no parental election is made.

Click here to access the tax rate schedule. If required, round the tax

computations to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock