Question: In 2 0 2 4 , Lisa and Fred, a married couple, had taxable income of $ 4 1 3 , 8 0 0 .

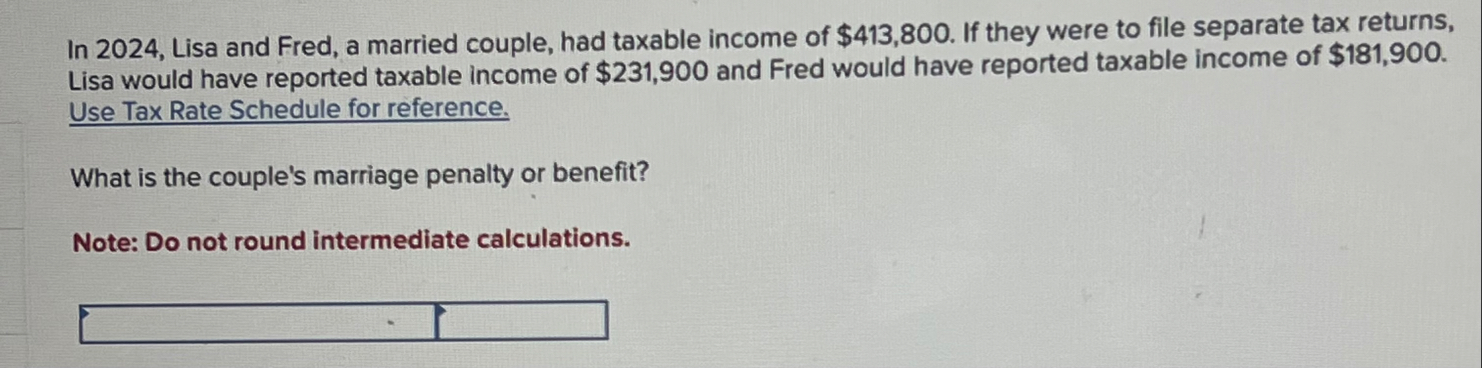

In Lisa and Fred, a married couple, had taxable income of $ If they were to file separate tax returns, Lisa would have reported taxable income of $ and Fred would have reported taxable income of $ Use Tax Rate Schedule for reference.

What is the couple's marriage penalty or benefit?

Note: Do not round intermediate calculations.

In Jasmine and Thomas, a married couple, had taxable income of $ If they were to file separate tax returns, Jasmine would have reported taxable income of $ and Thomas would have reported taxable income of $ Use Tax Rate Schedule for reference.

What is the couple's marriage penalty or benefit?

Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar.

Whitney received $ of taxable income in All of the income was salary from her employer. What is her income tax liability in each of the following alternative situations?

Use Tax Rate Schedule for reference.

Note: Do not round intermediate calculations.

Problem Part c Algo

c She is married but files a separate tax return. Her taxable income is $

Income tax liabilityWhitney received $ of taxable income in All of the income was salary from her employer. What is her income tax liability in each of the following alternative situations?

Use Tax Rate Schedule for reference.

Note: Do not round intermediate calculations.

Problem Part d Algo

d She files as a head of household.

Income tax liability

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock