Question: In 2 0 X 1 , Phillips Company reported $ 1 0 , 0 0 0 , 0 0 0 of pre - tax book

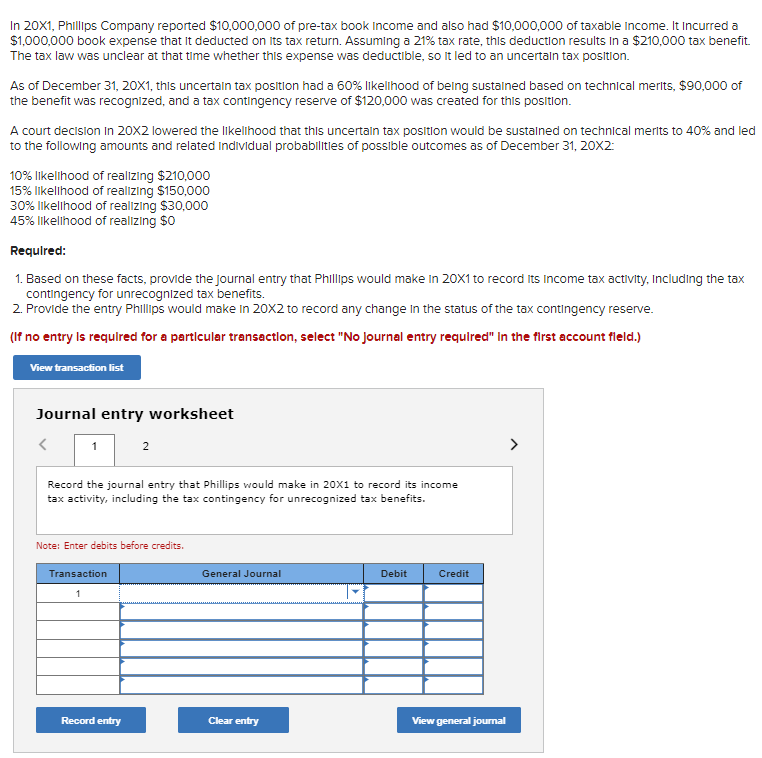

In X Phillips Company reported $ of pretax book Income and also had $ of taxable Income. It Incurred a

$ book expense that it deducted on its tax return. Assuming a tax rate, this deduction results in a $ tax benefit.

The tax law was unclear at that time whether this expense was deductible, so it led to an uncertaln tax position.

As of December this uncertain tax position had a likellhood of being sustained based on technical merits, $ of

the benefit was recognized, and a tax contingency reserve of $ was created for this position.

A court decision in X lowered the likelihood that this uncertain tax position would be sustained on technical merits to and led

to the following amounts and related individual probabilitles of possible outcomes as of December times :

likellhood of realizing $

likelihood of realizing $

likellhood of reallzing $

likellhood of realizing $

Required:

Based on these facts, provide the journal entry that Phillips would make in to record its income tax activity, Including the tax

contingency for unrecognized tax benefits.

Provide the entry Phillips would make in to record any change in the status of the tax contingency reserve.

If no entry is required for a particular transaction, select No Journal entry required" In the first account fleld.

Journal entry worksheet

Record the journal entry that Phillips would make in to record its income

tax activity, including the tax contingency for unrecognized tax benefits.

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock