Question: In 2015, Carson is claimed as a dependent on his parent's tax return. His parents' ordinary income marginal tax rate is 28 percent. Carson's parents

| In 2015, Carson is claimed as a dependent on his parent's tax return. His parents' ordinary income marginal tax rate is 28 percent. Carson's parents provided most of his support.

What is Carson's tax liability for the year in each of the following alternative circumstances?

|

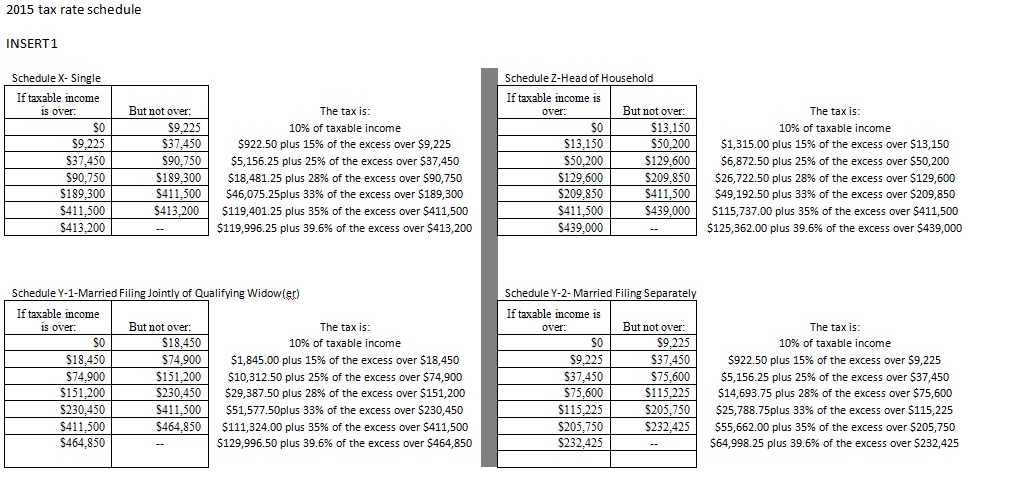

2015 tax rate schedule INSERT1 Schedule X- Single Schedule Z-Head of Household If taxable income 3 over. If taxable income is Butnot over Butnot over The tax is 10% of taxable income $922.50 plus 15% of the excess over $9,225 $5,156.25 plus 25% of the excess over $37,450 $18,481.25 plus 28% of the excess over $90,750 $46,075.25plus 33% of the excess over $189,300 $119,401.25 plus 35% of the excess over $411,500 $119,996.25 plus 39.6% of the excess over $413,200 The tax is 10% of taxable income $1,315.00 plus 15% of the excess over $13,150 $6,872.50 plus 25% of the excess over $50,200 $26,722.50 plus 28% of the excess over $129,600 $49,192.50 plus 33% of the excess over $209,850 $115,737.00 plus 35% of the excess over $411,500 $125,362.00 plus 39.6% of the excess over $439,000 over S0 9.225 537,450 $90,750 $189,300 $411,500 $413,200 9,225 537,450 $90.750 | S 189.300 | 411,500| S0 $13,150 50.200 129,600 $209,850 $411,500 S439,000 $13,150 50.200 | S 129.600 S209.850 | S4 11.500 | $439,000 S413 Schedule Y-1-Married Filing Jointly of Qualifying Widowier) Schedule Y-2- Married Filing Separately If taxable income 3 over. If taxable income is But not over But not over The tax is 10% of taxable income $1,845.00 plus 15% of the excess over $18,450 $10,312.50 plus 25% of the excess over $74,900 $29,387.50 plus 28% of the excess over $151,200 $51,577.50plus 33% of the excess over $230,450 $111,324.00 plus 35% of the excess over $411,500 $129,996.50 plus 39.6% of the excess over $464,850 The tax is 10% of taxable income $922.50 plus 15% of the excess over $9,225 $5,156.25 plus 25% of the excess over $37,450 $14593.75 plus 28% of the excess over $75,600 $25,788.75plus 33% of the excess over $115,225 $55,662.00 plus 35% of the excess over $205,750 $64,998.25 plus 39.6% of the excess over $232,425 over S0 S18,450 $74,900 151,200 S18,450 $74.900 | $151,200 | $230,450 | 411.500| $464.850 S9 S0 9,225 S37,450 $75,600 S115,225 S37,450 75.600 | SI 15.225 | 205,750 | $232,425 | $411,500 $464,850 S232,425

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts