Question: In 2022, Elaine paid $2,200 of tuition and $720 for books for her dependent son to attend State University this past fall as a freshman.

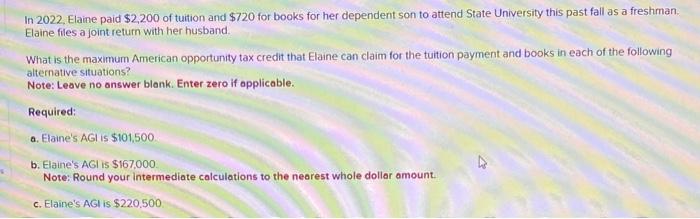

In 2022, Elaine paid $2,200 of tuition and $720 for books for her dependent son to attend State University this past fall as a freshman.

Elaine files a joint return with her husband.

What is the maximum American opportunity tax credit that Elaine can claim for the tuition payment and books in each of the following alternative situations?

Note: Leave no answer blank. Enter zero if applicable.

Required:

- Elaine's AGI is $101,500.

- Elaine's AGI is $167,000. Note: Round your intermediate calculations to the nearest whole dollar amount.

- Elaine's AGI is $220,500.

In 2022 . Elaine paid $2,200 of tuition and $720 for books for her dependent son to attend State University this past fall as a freshman. Elaine files a joint return with her husband. What is the maximum American opportunity tax credit that Elaine can claim for the tuition payment and books in each of the following alternative situations? Note: Leave no answer blank. Enter zero if applicable. Required: a. Elaine's AGl is $101,500 b. Elaine's AGi is $167,000 Note: Round your intermediate calculations to the nearest whole dollar amount. c. Elaine's AGl is $220,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts