Question: In 2022, Pharoah Construction Company Ltd. applied the completed-contract method of accounting for long-term construction contracts. However, in 2023, Pharoah discovered that the percentage-of-completion method

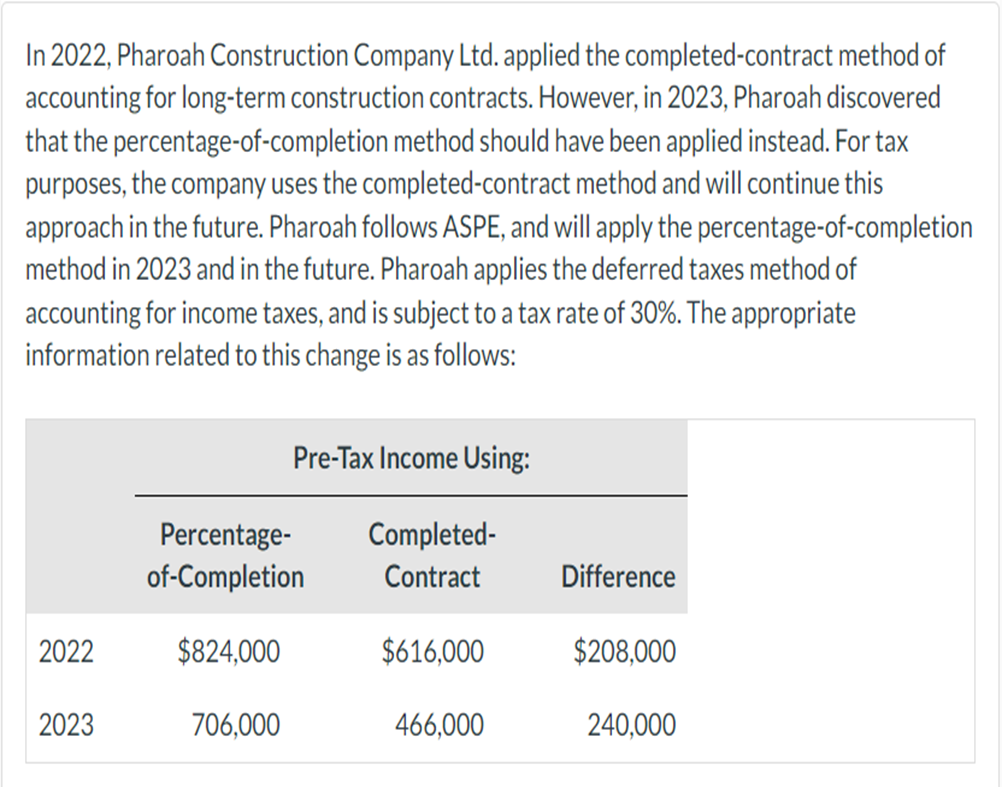

In 2022, Pharoah Construction Company Ltd. applied the completed-contract method of accounting for long-term construction contracts. However, in 2023, Pharoah discovered that the percentage-of-completion method should have been applied instead. For tax purposes, the company uses the completed-contract method and will continue this approach in the future. Pharoah follows ASPE, and will apply the percentage-of-completion method in 2023 and in the future. Pharoah applies the deferred taxes method of accounting for income taxes, and is subject to a tax rate of 30%. The appropriate information related to this change is as follows: Calculate the net income to be reported in 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts