Question: In 2022, using a cryptocurrency platform, Sam sold Bitcoin that he held as a capital asset, as an individual. How will this sale be reported

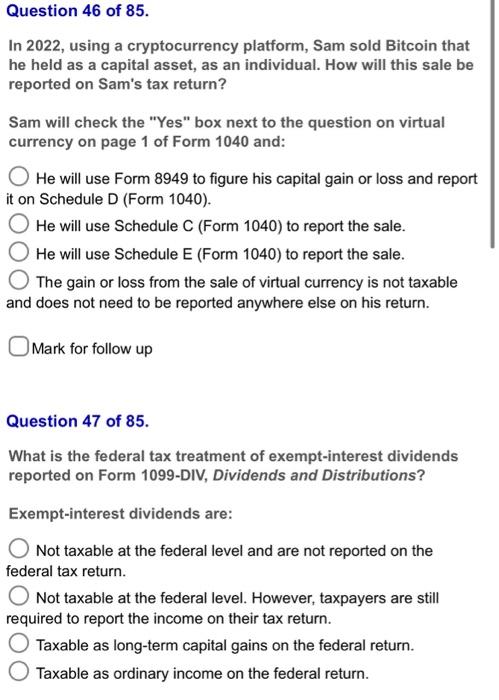

In 2022, using a cryptocurrency platform, Sam sold Bitcoin that he held as a capital asset, as an individual. How will this sale be reported on Sam's tax return? Sam will check the "Yes" box next to the question on virtual currency on page 1 of Form 1040 and: He will use Form 8949 to figure his capital gain or loss and report it on Schedule D (Form 1040). He will use Schedule C (Form 1040) to report the sale. He will use Schedule E (Form 1040) to report the sale. The gain or loss from the sale of virtual currency is not taxable and does not need to be reported anywhere else on his return. Mark for follow up Question 47 of 85. What is the federal tax treatment of exempt-interest dividends reported on Form 1099-DIV, Dividends and Distributions? Exempt-interest dividends are: Not taxable at the federal level and are not reported on the federal tax return. Not taxable at the federal level. However, taxpayers are still required to report the income on their tax return. Taxable as long-term capital gains on the federal return. Taxable as ordinary income on the federal return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts