Question: In 4. (15 marks) Recall the Black-Scholes model under the risk-neutral probability measure. particular, let the bank account and non-dividend paying stock satisfy dB =

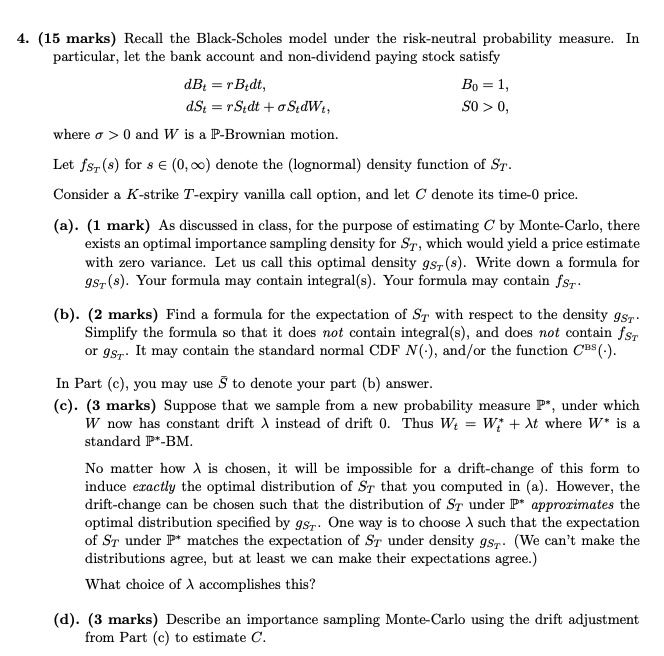

In 4. (15 marks) Recall the Black-Scholes model under the risk-neutral probability measure. particular, let the bank account and non-dividend paying stock satisfy dB = r Bedt, Bo = 1, dSt = r Sidt + o SidWt, SO > 0, where o >0 and W is a P-Brownian motion. Let fr(s) for s (0,00) denote the (lognormal) density function of Sr. Consider a K-strike T-expiry vanilla call option, and let C denote its time-0 price. (a). (1 mark) As discussed in class, for the purpose of estimating C by Monte-Carlo, there exists an optimal importance sampling density for St, which would yield a price estimate with zero variance. Let us call this optimal density gst (s). Write down a formula for 987 (s). Your formula may contain integral(s). Your formula may contain fsz. (b). (2 marks) Find a formula for the expectation of Sr with respect to the density Isr: Simplify the formula so that it does not contain integral(s), and does not contain for or gs. It may contain the standard normal CDF N(), and/or the function CBS (-). In Part (c), you may use S to denote your part (b) answer. (c). (3 marks) Suppose that we sample from a new probability measure P*, under which W now has constant drift instead of drift 0. Thus W = Wi + At where W* is a standard IP*-BM. No matter how is chosen, it will be impossible for a drift-change of this form to induce exactly the optimal distribution of Sr that you computed in (a). However, the drift-change can be chosen such that the distribution of Sr under P* approrimates the optimal distribution specified by gs. One way is to choose such that the expectation of Sr under P* matches the expectation of Sr under density gs. (We can't make the distributions agree, but at least we can make their expectations agree.) What choice of accomplishes this? (d). (3 marks) Describe an importance sampling Monte-Carlo using the drift adjustment from Part (c) to estimate C. In 4. (15 marks) Recall the Black-Scholes model under the risk-neutral probability measure. particular, let the bank account and non-dividend paying stock satisfy dB = r Bedt, Bo = 1, dSt = r Sidt + o SidWt, SO > 0, where o >0 and W is a P-Brownian motion. Let fr(s) for s (0,00) denote the (lognormal) density function of Sr. Consider a K-strike T-expiry vanilla call option, and let C denote its time-0 price. (a). (1 mark) As discussed in class, for the purpose of estimating C by Monte-Carlo, there exists an optimal importance sampling density for St, which would yield a price estimate with zero variance. Let us call this optimal density gst (s). Write down a formula for 987 (s). Your formula may contain integral(s). Your formula may contain fsz. (b). (2 marks) Find a formula for the expectation of Sr with respect to the density Isr: Simplify the formula so that it does not contain integral(s), and does not contain for or gs. It may contain the standard normal CDF N(), and/or the function CBS (-). In Part (c), you may use S to denote your part (b) answer. (c). (3 marks) Suppose that we sample from a new probability measure P*, under which W now has constant drift instead of drift 0. Thus W = Wi + At where W* is a standard IP*-BM. No matter how is chosen, it will be impossible for a drift-change of this form to induce exactly the optimal distribution of Sr that you computed in (a). However, the drift-change can be chosen such that the distribution of Sr under P* approrimates the optimal distribution specified by gs. One way is to choose such that the expectation of Sr under P* matches the expectation of Sr under density gs. (We can't make the distributions agree, but at least we can make their expectations agree.) What choice of accomplishes this? (d). (3 marks) Describe an importance sampling Monte-Carlo using the drift adjustment from Part (c) to estimate C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts