Question: In a excel format Given the following information for McCumber Energy: Debt - 7,000 6 percent coupon bonds outstanding, $1,000 par value, 25 years to

In a excel format

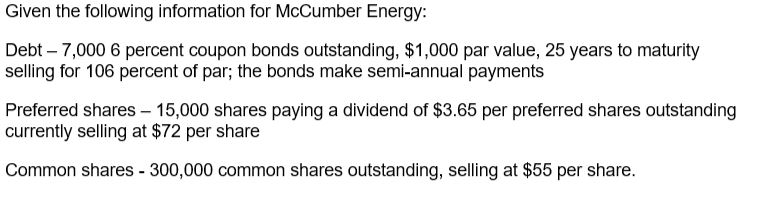

Given the following information for McCumber Energy: Debt - 7,000 6 percent coupon bonds outstanding, $1,000 par value, 25 years to maturity selling for 106 percent of par; the bonds make semi-annual payments Preferred shares - 15,000 shares paying a dividend of $3.65 per preferred shares outstanding currently selling at $72 per share Common shares - 300,000 common shares outstanding, selling at $55 per share. Given the following information for McCumber Energy: Debt - 7,000 6 percent coupon bonds outstanding, $1,000 par value, 25 years to maturity selling for 106 percent of par; the bonds make semi-annual payments Preferred shares - 15,000 shares paying a dividend of $3.65 per preferred shares outstanding currently selling at $72 per share Common shares - 300,000 common shares outstanding, selling at $55 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts