Question: In a fixed-term, level-payment reverse mortgage, sometimes called a reverse annuity mortgage, or RAM, a lender agrees to pay the homeowner a monthly payment, or

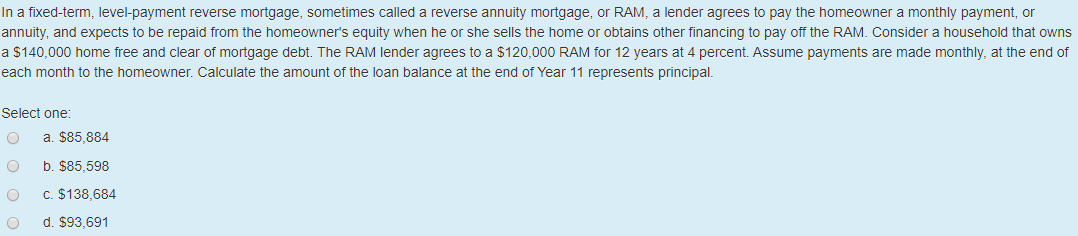

In a fixed-term, level-payment reverse mortgage, sometimes called a reverse annuity mortgage, or RAM, a lender agrees to pay the homeowner a monthly payment, or annuity, and expects to be repaid from the homeowner's equity when he or she sells the home or obtains other financing to pay off the RAM. Consider a household that owns a $140,000 home free and clear of mortgage debt. The RAM lender agrees to a $120,000 RAM for 12 years at 4 percent. Assume payments are made monthly, at the end of each month to the homeowner. Calculate the amount of the loan balance at the end of Year 11 represents principal. Select one: 0 a. $85.884 o b. $85.598 0 C. $138,684 O d. $93,691

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts