Question: In a job order coming system: a. Standards cannot be used. b. An average cost per unit within a job cannot be computed. c. Costs

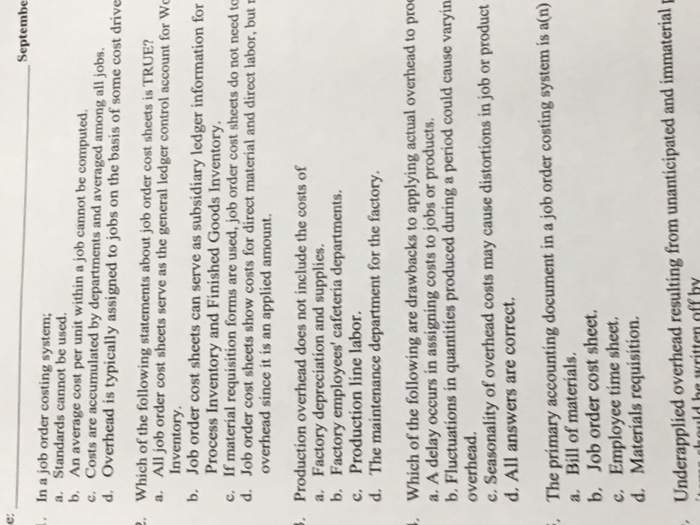

In a job order coming system: a. Standards cannot be used. b. An average cost per unit within a job cannot be computed. c. Costs are accumulated by departments and averaged among all jobs. d. Overhead is typically assigned to jobs on the basis of some cost drive Which of the following statements about job order cost sheath is TRUE? a. All job order cost sheets serve as the general ledger control account for Wc Inventory. b. Job order cost sheets can serve as subsidiary ledger information for Process Inventory and Finished Goods Inventory. c. If material requisition forms are used, job order cost sheets do not need to d. Job order cost sheets show costs for direct material and direct labor, but overhead since it is an applied amount. Production overhead docs not include the costs of a. Factory depreciation and supplies. b. Factory employees' cafeteria departments. c. Production line labor. d. The maintenance department for the factory. Which of the following are drawbacks to applying actual overhead to pro a. A delay occurs in assigning costs to job or products. b. Fluctuations in quantities produced during a period could cause varying overhead. c. Seasonality of overhead costs may cause distortions in job or product d. All answers are correct. The primary accounting document in a job order costing system is a(n) a. Bill of materials. b. Job order cost sheet. c. Employee time sheet. d. Materials requisition. Underapplied overhead resulting from unanticipated and immaterial

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts