Question: In a normal interest rate environment, with an upward sloping yield curve, 30-year Treasury bonds have higher yields than 2-year Treasury bonds. Which of the

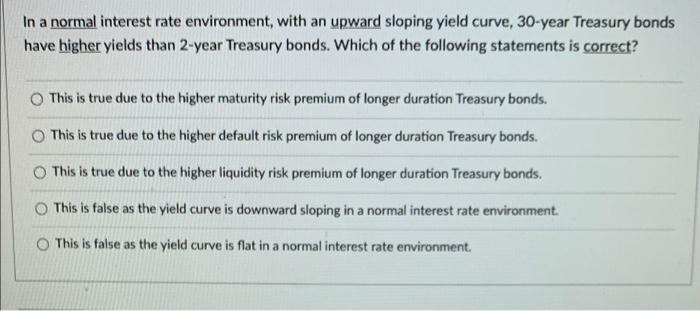

In a normal interest rate environment, with an upward sloping yield curve, 30-year Treasury bonds have higher yields than 2-year Treasury bonds. Which of the following statements is correct? This is true due to the higher maturity risk premium of longer duration Treasury bonds. This is true due to the higher default risk premium of longer duration Treasury bonds. This is true due to the higher liquidity risk premium of longer duration Treasury bonds. This is false as the yield curve is downward sloping in a normal interest rate environment. This is false as the yield curve is flat in a normal interest rate environment

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock