Question: In a risk-averse world, the CAPM is a model that allows us to calculate expected returns and thus the cost of capital. In this context,

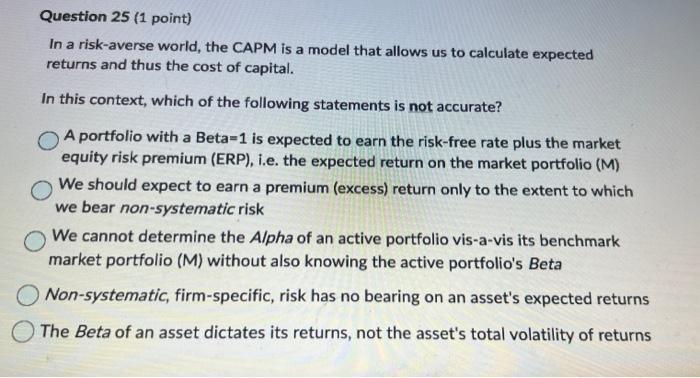

In a risk-averse world, the CAPM is a model that allows us to calculate expected returns and thus the cost of capital. In this context, which of the following statements is not accurate? A portfolio with a Beta =1 is expected to earn the risk-free rate plus the market equity risk premium (ERP), i.e. the expected return on the market portfolio (M) We should expect to earn a premium (excess) return only to the extent to which we bear non-systematic risk We cannot determine the A/pha of an active portfolio vis-a-vis its benchmark market portfolio (M) without also knowing the active portfolio's Beta Non-systematic, firm-specific, risk has no bearing on an asset's expected returns The Beta of an asset dictates its returns, not the asset's total volatility of returns In a risk-averse world, the CAPM is a model that allows us to calculate expected returns and thus the cost of capital. In this context, which of the following statements is not accurate? A portfolio with a Beta =1 is expected to earn the risk-free rate plus the market equity risk premium (ERP), i.e. the expected return on the market portfolio (M) We should expect to earn a premium (excess) return only to the extent to which we bear non-systematic risk We cannot determine the A/pha of an active portfolio vis-a-vis its benchmark market portfolio (M) without also knowing the active portfolio's Beta Non-systematic, firm-specific, risk has no bearing on an asset's expected returns The Beta of an asset dictates its returns, not the asset's total volatility of returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts