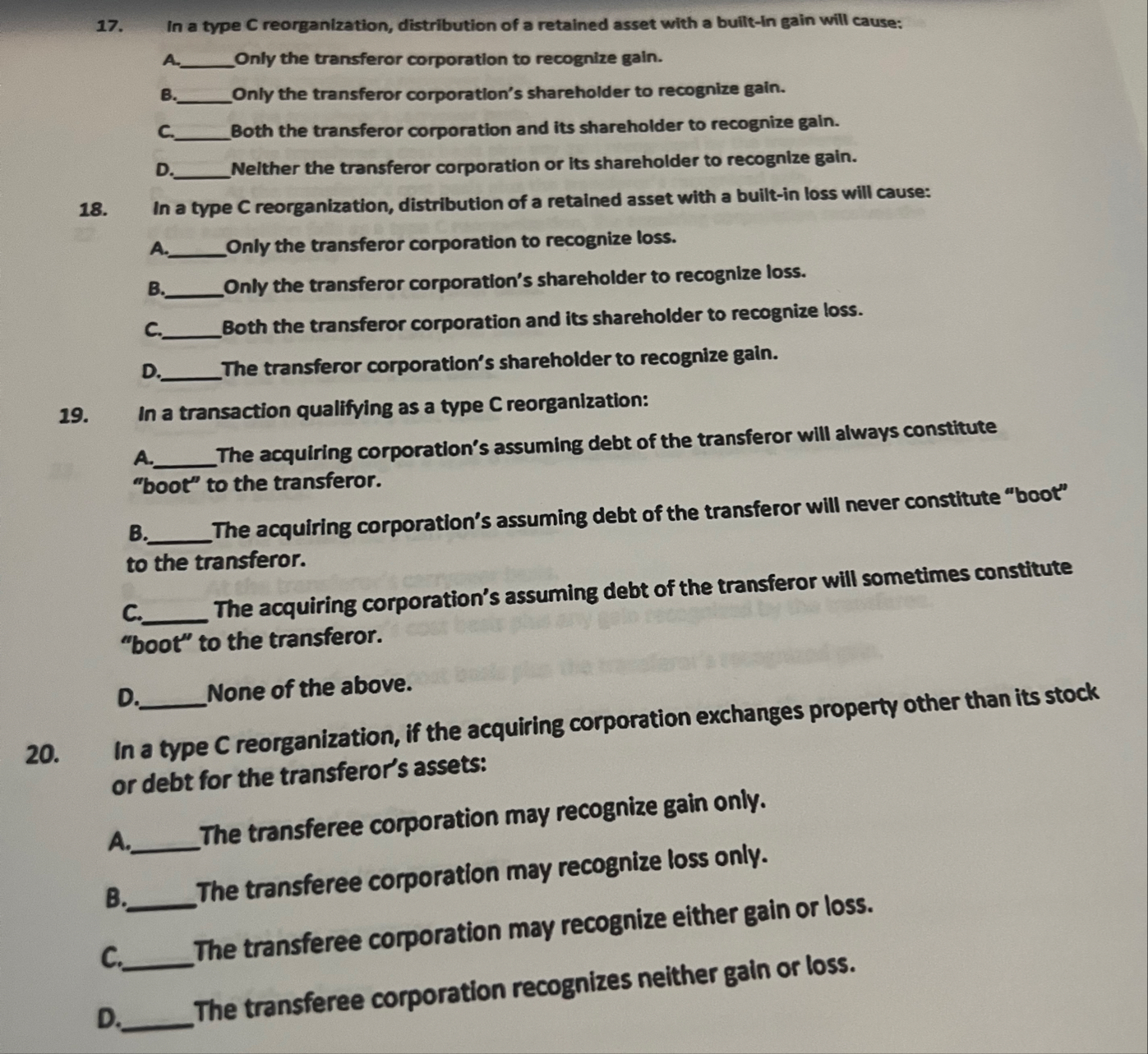

Question: In a type C reorganization, distribution of a retained asset with a built - In gain will cause: A Only the transferor corporation to recognize

In a type C reorganization, distribution of a retained asset with a builtIn gain will cause:

A Only the transferor corporation to recognize gain.

B Only the transferor corporation's shareholder to recognize gain.

C Both the transferor corporation and its shareholder to recognize gain.

D Nelther the transferor corporation or its shareholder to recognize gain.

In a type C reorganization, distribution of a retained asset with a builtin loss will cause:

A Only the transferor corporation to recognize loss.

B Only the transferor corporation's shareholder to recognize loss.

C Both the transferor corporation and its shareholder to recognize loss.

D The transferor corporation's shareholder to recognize gain.

In a transaction qualifying as a type C reorganization:

A The acquiring corporation's assuming debt of the transferor will always constitute "boot" to the transferor.

B The acquiring corporation's assuming debt of the transferor will never constitute "boot" to the transferor.

C The acquiring corporation's assuming debt of the transferor will sometimes constitute "boot" to the transferor.

D Vone of the above.

In a type C reorganization, if the acquiring corporation exchanges property other than its stock or debt for the transferor's assets:

A The transferee corporation may recognize gain only.

B The transferee corporation may recognize loss only.

c The transferee corporation may recognize either gain or loss.

D The transferee corporation recognizes neither gain or loss.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock