Question: a. b. C. d. Azrie owns 2 units of apartment and lets out those units to 2 tenants. The tenants are entitled to use

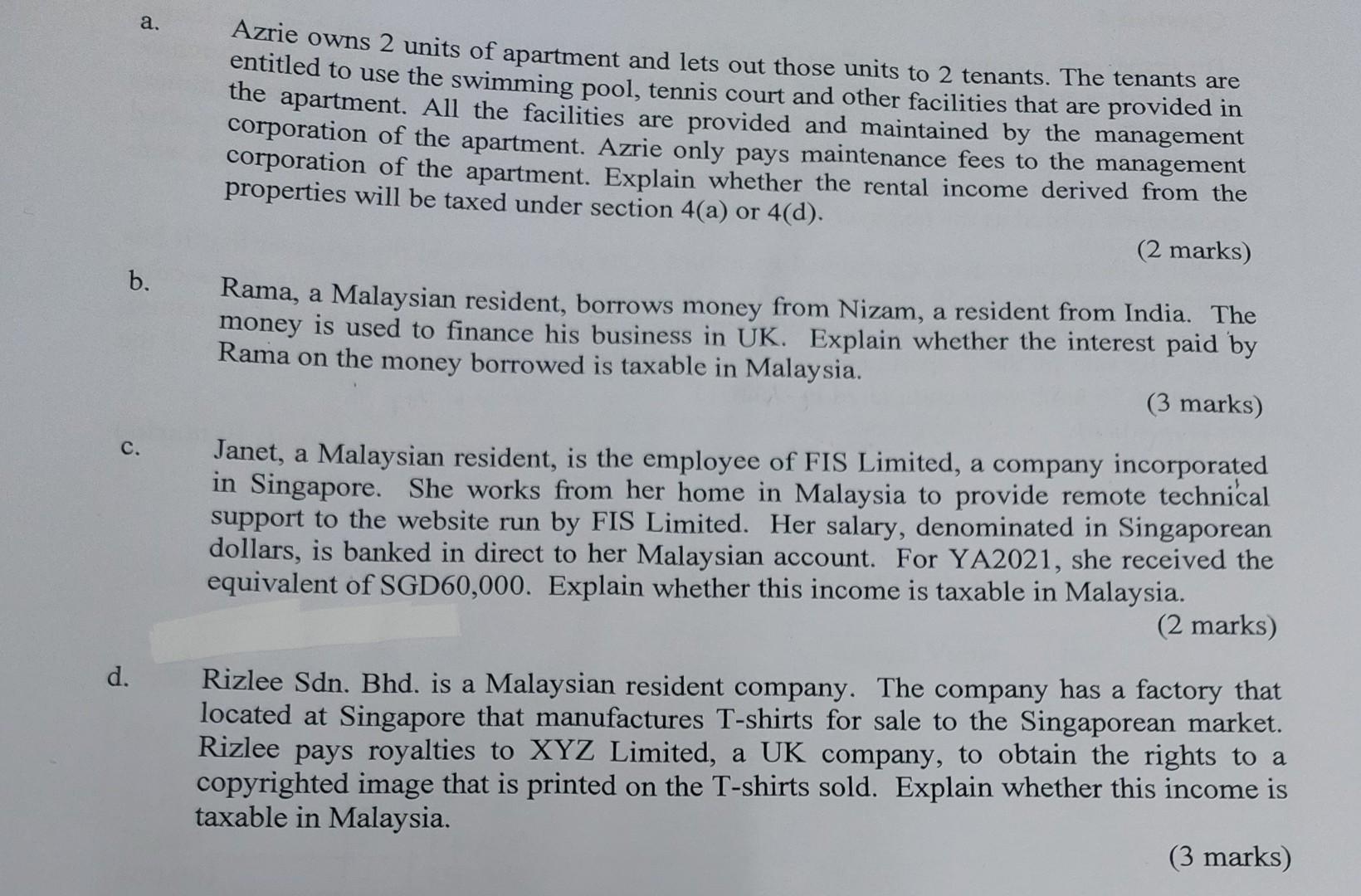

a. b. C. d. Azrie owns 2 units of apartment and lets out those units to 2 tenants. The tenants are entitled to use the swimming pool, tennis court and other facilities that are provided in the apartment. All the facilities are provided and maintained by the management corporation of the apartment. Azrie only pays maintenance fees to the management corporation of the apartment. Explain whether the rental income derived from the properties will be taxed under section 4(a) or 4(d). (2 marks) Rama, a Malaysian resident, borrows money from Nizam, a resident from India. The money is used to finance his business in UK. Explain whether the interest paid by Rama on the money borrowed is taxable in Malaysia. (3 marks) Janet, a Malaysian resident, is the employee of FIS Limited, a company incorporated in Singapore. She works from her home in Malaysia to provide remote technical support to the website run by FIS Limited. Her salary, denominated in Singaporean dollars, is banked in direct to her Malaysian account. For YA2021, she received the equivalent of SGD60,000. Explain whether this income is taxable in Malaysia. (2 marks) Rizlee Sdn. Bhd. is a Malaysian resident company. The company has a factory that located at Singapore that manufactures T-shirts for sale to the Singaporean market. Rizlee pays royalties to XYZ Limited, a UK company, to obtain the rights to a copyrighted image that is printed on the T-shirts sold. Explain whether this income is taxable in Malaysia. (3 marks)

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

a Taxation of Rental Income The taxation of rental income in Malaysia depends on the specific provisions of the Income Tax Act 1967 In this case Azrie owns two apartment units and rents them out to te... View full answer

Get step-by-step solutions from verified subject matter experts