Question: In a year when the maximum income for social secunity was $118.500, Bart worked at two jobs. In one job he earned 599.112. In his

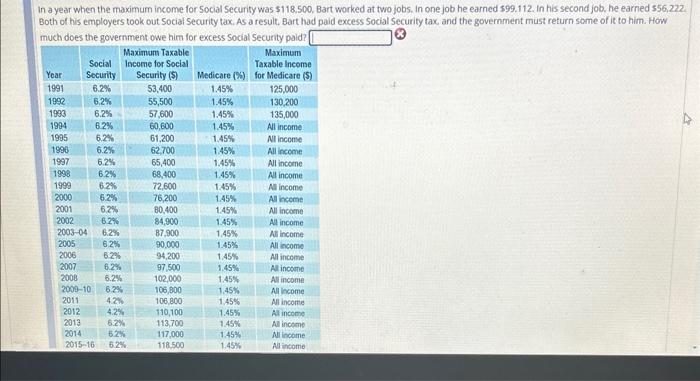

In a year when the maximum income for social secunity was $118.500, Bart worked at two jobs. In one job he earned 599.112. In his second job. he earned 556,222. Both of his employers took out Social Security tax. As a result, Bart had paid excess Social Security tax, and the government must return some of it to him. How much does the government owe him for excess social Security paid? In a year when the maximum income for social secunity was $118.500, Bart worked at two jobs. In one job he earned 599.112. In his second job. he earned 556,222. Both of his employers took out Social Security tax. As a result, Bart had paid excess Social Security tax, and the government must return some of it to him. How much does the government owe him for excess social Security paid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts