Question: . In addition, pick at least one appropriate for this statement) ratio or financial in addition to what is provided and calculate that and explain

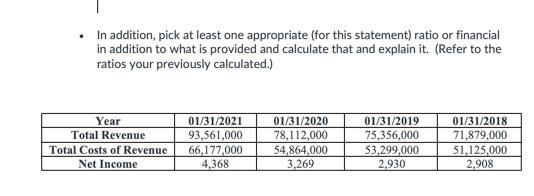

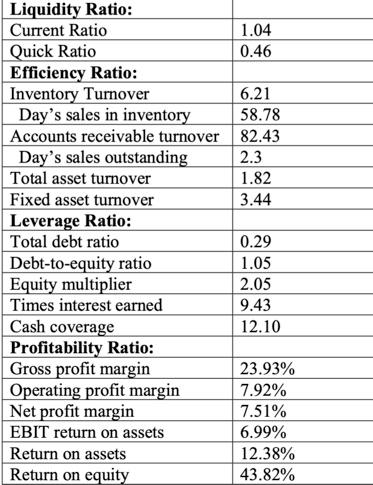

. In addition, pick at least one appropriate for this statement) ratio or financial in addition to what is provided and calculate that and explain it. (Refer to the ratios your previously calculated.) Year Total Revenue Total Costs of Revenue Net Income 01/31/2021 93,561,000 66,177,000 4,368 01/31/2020 78,112,000 54,864,000 3,269 01/31/2019 75,356,000 53,299.000 2.930 01/31/2018 71,879,000 51,125.000 2.908 Liquidity Ratio: Current Ratio 1.04 Quick Ratio 0.46 Efficiency Ratio: Inventory Turnover 6.21 Day's sales in inventory 58.78 Accounts receivable turnover 82.43 Day's sales outstanding 2.3 Total asset turnover 1.82 Fixed asset turnover 3.44 Leverage Ratio: Total debt ratio 0.29 Debt-to-equity ratio 1.05 Equity multiplier 2.05 Times interest earned 9.43 Cash coverage 12.10 Profitability Ratio: Gross profit margin 23.93% Operating profit margin 7.92% Net profit margin 7.51% EBIT return on assets 6.99% Return on assets 12.38% Return on equity 43.82% . In addition, pick at least one appropriate for this statement) ratio or financial in addition to what is provided and calculate that and explain it. (Refer to the ratios your previously calculated.) Year Total Revenue Total Costs of Revenue Net Income 01/31/2021 93,561,000 66,177,000 4,368 01/31/2020 78,112,000 54,864,000 3,269 01/31/2019 75,356,000 53,299.000 2.930 01/31/2018 71,879,000 51,125.000 2.908 Liquidity Ratio: Current Ratio 1.04 Quick Ratio 0.46 Efficiency Ratio: Inventory Turnover 6.21 Day's sales in inventory 58.78 Accounts receivable turnover 82.43 Day's sales outstanding 2.3 Total asset turnover 1.82 Fixed asset turnover 3.44 Leverage Ratio: Total debt ratio 0.29 Debt-to-equity ratio 1.05 Equity multiplier 2.05 Times interest earned 9.43 Cash coverage 12.10 Profitability Ratio: Gross profit margin 23.93% Operating profit margin 7.92% Net profit margin 7.51% EBIT return on assets 6.99% Return on assets 12.38% Return on equity 43.82%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts