Question: In addition to testing for purchasing power parity (PPP) by plotting individual points (combinations of interest rate differentials and changes in the spot rate

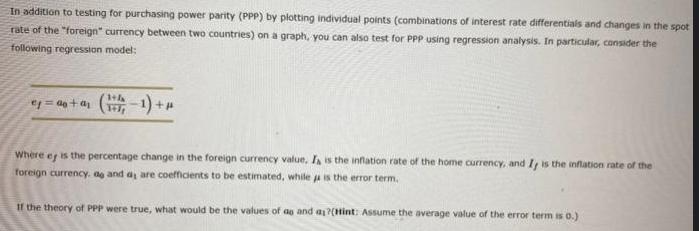

In addition to testing for purchasing power parity (PPP) by plotting individual points (combinations of interest rate differentials and changes in the spot rate of the "foreign currency between two countries) on a graph, you can also test for PPP using regression analysis. In particular, consider the following regression model: ey=+ (1-1)+ Where a of is the percentage change in the foreign currency value. It is the inflation rate of the home currency, and It is the inflation rate of the foreign currency. ag and d, are coefficients to be estimated, while ja is the error term. If the theory of PPP were true, what would be the values of as and ar?(Hint: Assume the average value of the error term is 0.)

Step by Step Solution

There are 3 Steps involved in it

1 FALSE results of regression analysis will be different 2 All of the following apply a change in relative interest rate b change in expectation of fu... View full answer

Get step-by-step solutions from verified subject matter experts