Question: In addition to the two assets given in problem 3, there is third asset which has the following returns over the ten periods: 19%, 15%,

In addition to the two assets given in problem 3, there is third asset which has the following returns over the ten periods: 19%, 15%, 12%, 17%, 10%, 9%, 18%, 14%, 18%, 8%. You desire an expected rate of return of 12% with minimum variance. Short sales are not allowed.

a. Write out the Markowitz formulation for this case.

b. Solve in Excel.

c. Determine the portfolio risk.

d. Repeat steps a, b, and c for an expected rate of return of 10%.

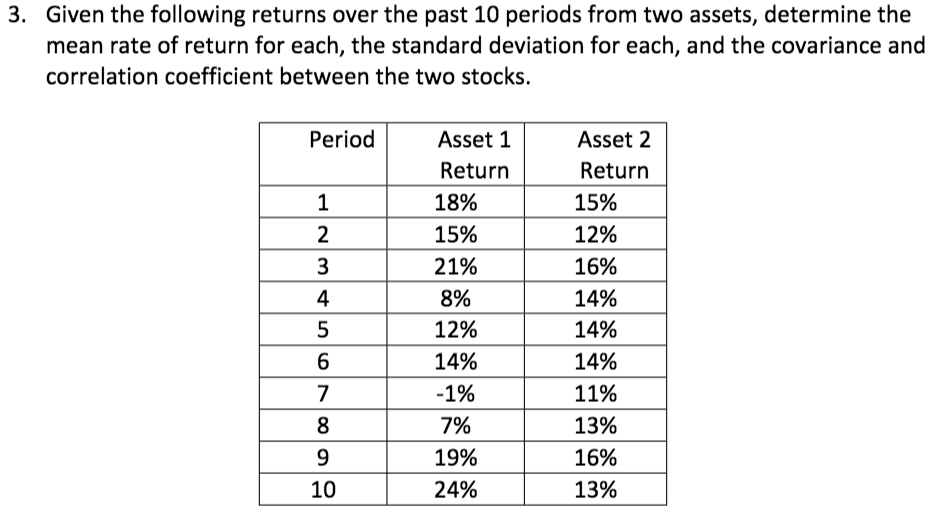

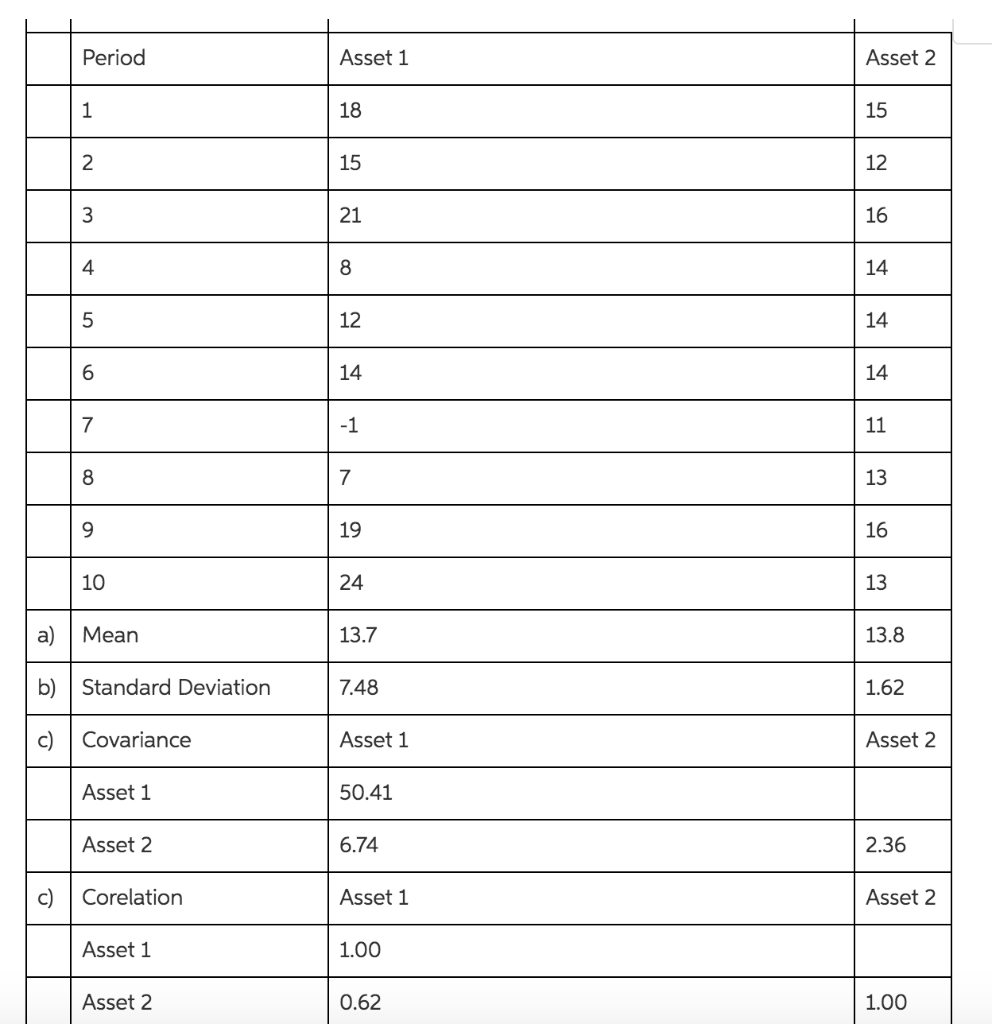

3. Given the following returns over the past 10 periods from two assets, determine the mean rate of return for each, the standard deviation for each, and the covariance and correlation coefficient between the two stocks. Period 1 2 3 4 5 Asset 1 Return 18% 15% 21% 8% 12% 14% -1% 7% 19% 24% Asset 2 Return 15% 12% 16% 14% 14% 14% 11% 13% 16% 13% 6 7 8 9 10 Period Asset 1 Asset 2 1 18 15 2 15 12 3 21 16 4 8 14 5 12 14 6 14 14 7 -1 11 8 7 13 9 19 16 10 24 13 a) Mean 13.7 13.8 b) Standard Deviation 7.48 1.62 c) Covariance Asset 1 Asset 2 Asset 1 50.41 Asset 2 6.74 2.36 c) Corelation Asset 1 Asset 2 Asset 1 1.00 Asset 2 0.62 1.00 3. Given the following returns over the past 10 periods from two assets, determine the mean rate of return for each, the standard deviation for each, and the covariance and correlation coefficient between the two stocks. Period 1 2 3 4 5 Asset 1 Return 18% 15% 21% 8% 12% 14% -1% 7% 19% 24% Asset 2 Return 15% 12% 16% 14% 14% 14% 11% 13% 16% 13% 6 7 8 9 10 Period Asset 1 Asset 2 1 18 15 2 15 12 3 21 16 4 8 14 5 12 14 6 14 14 7 -1 11 8 7 13 9 19 16 10 24 13 a) Mean 13.7 13.8 b) Standard Deviation 7.48 1.62 c) Covariance Asset 1 Asset 2 Asset 1 50.41 Asset 2 6.74 2.36 c) Corelation Asset 1 Asset 2 Asset 1 1.00 Asset 2 0.62 1.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts