Question: In an efficient market, a stock with a standard deviation of returns of 12% could have a higher expected return than a stock with a

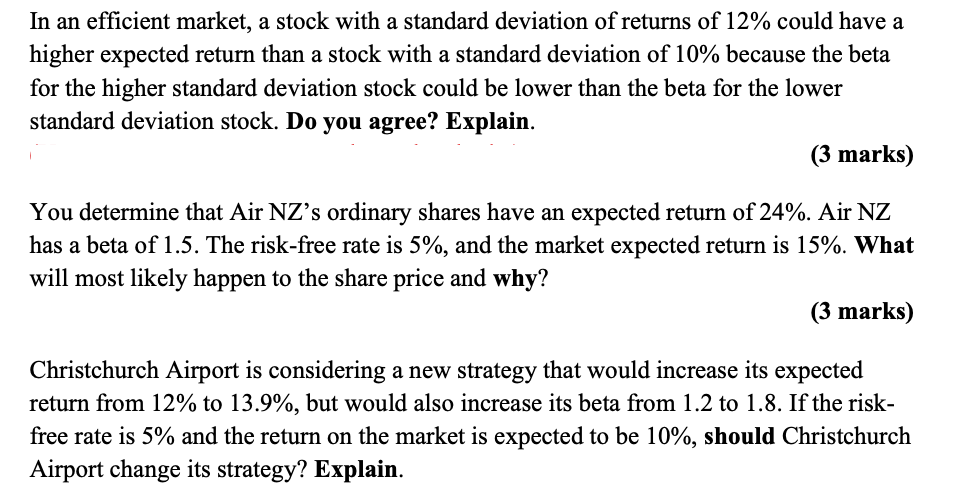

In an efficient market, a stock with a standard deviation of returns of 12% could have a higher expected return than a stock with a standard deviation of 10% because the beta for the higher standard deviation stock could be lower than the beta for the lower standard deviation stock. Do you agree? Explain. (3 marks) You determine that Air NZ's ordinary shares have an expected return of 24%. Air NZ has a beta of 1.5. The risk-free rate is 5%, and the market expected return is 15%. What will most likely happen to the share price and why? (3 marks) Christchurch Airport is considering a new strategy that would increase its expected return from 12% to 13.9%, but would also increase its beta from 1.2 to 1.8. If the risk- free rate is 5% and the return on the market is expected to be 10%, should Christchurch Airport change its strategy? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts