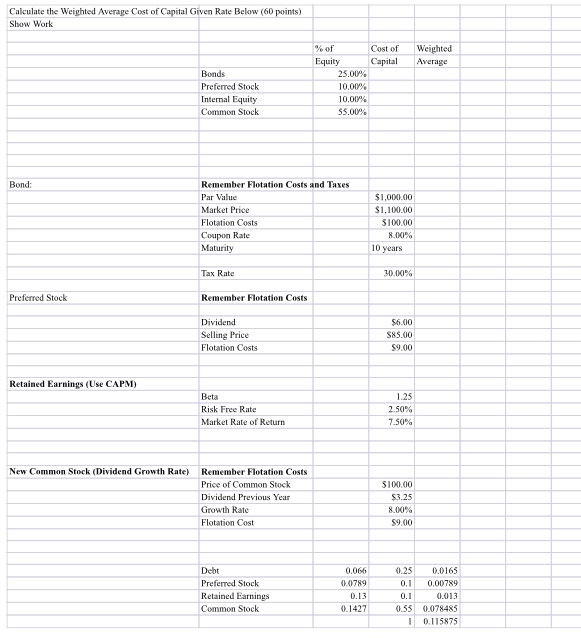

Question: in an excel format, can you please solve the following! thanks! Calculate the weighted Average Cost of Capital Given Rate Below (60 points) Show Work

Calculate the weighted Average Cost of Capital Given Rate Below (60 points) Show Work Cost of Capital Weighted Average Bonds Preferred Stock Internal Equity Common Stock % of Equity 25.00% 10.00% 10.00% 55.00% Remember Flotation Costs and Taxes Par Value Market Price Flotation Costs Coupon Rate Maturity $1.001.00 $1.100.00 S100.00 X% 10 years Tax Rate 30.01% Preferred Stock Remember Flotation Costs Dividend Selling Price Flotation Costs $6.00 S85 0 59.00 Retained Earnings (Use CAPM) 1.25 Beta Risk Free Rate Market Rate of Return 2.50% 7. 50% New Common Stock (Dividend Growth Rate) Remember Flotation Costs Price of Common Stock Dividend Previous Year Growth Rate Flotation Cost S100.00 $3.25 8.00% 59.00 Debt Preferred Stock Retained Earnings Common Stock 0.066 0.0789 0.13 0.1427 0.25 0.0165 0.1 0.00789 0.1 0.013 0.55 0.078485 10.115875

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts