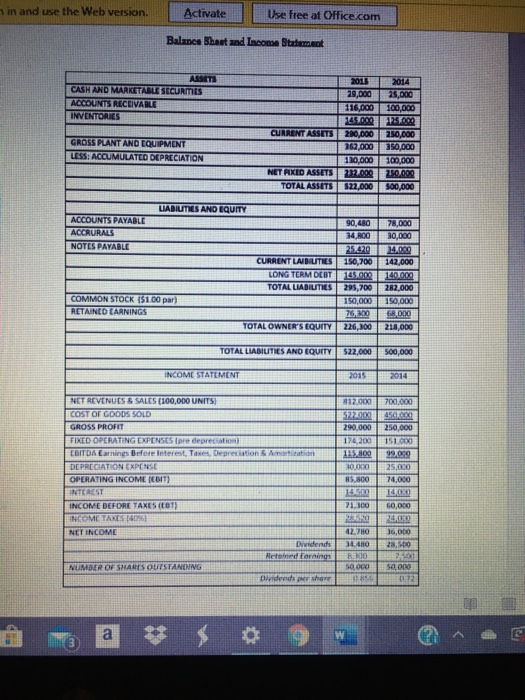

Question: in and use the Web version Activate Use free at Office.com Balance Blant and Income Street 2016 2017 ASSETS CASH AND MARKETABLE SECURMES ACCOUNTS TRECUVARLI

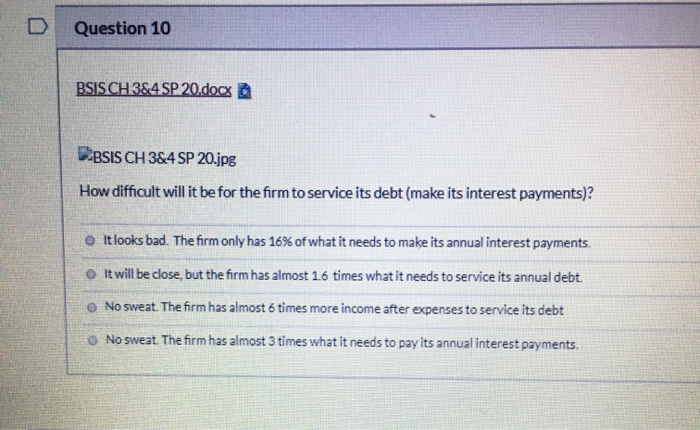

in and use the Web version Activate Use free at Office.com Balance Blant and Income Street 2016 2017 ASSETS CASH AND MARKETABLE SECURMES ACCOUNTS TRECUVARLI INVENTORIES GROSS PLANT AND EQUIPMENT LESS ACCUMULATED DEPRECIATION 116.000 100 TOOD 165.000 15.000 CURRENTASSETSTOOOOOO 252 000 110.000 100.0 NET REKID ASSETS 1 000 20000 TOTAL ASSETS 27.000 100.000 LABIULES AND EQUITY ACCOUNTS PAYABLE ACCRURALS NOTES PAYABLE 90RO 34 ROO 78,000 30.000 25.42034.000 142.000 CURRENT LABUTIES 150,700 LONG TERM DEBT10000 TOTAL LIABILITIES 295,700 150,000 COMMON STOCK ($1.00 par) RETANCO CARNINGS 140.000 282,000 150.000 68,000 210.000 76, TOTAL OWNER'S EQUITY 226,300 TOTAL LIABILITIES AND EQUITY 522,000 500,000 INCOME STATEMENT 522000 45000 170200 115,00 151.000 13.00 NET REVENUES ALES 100,000 UNITS COST OF GOODS SOLD GROSS PROFIT TIXED OPERATING EXPENSES Tore depreciation EBITDA Earnings Before Interest, Taxes, Degretion DEPREGIATION EXPENSE OPERATING INCOME BIT) INTEREST INCOME BEFORE TAXES ET) COME TAXES NET INCOME 13 7100 12.70 Dividends BO 50O NUMBER OF SHARES OU sa 200 ,000 12 e dirds per D Question 10 BSISCH 3&4SP 20.docx DBSIS CH 3&4 SP 20.jpg How difficult will it be for the firm to service its debt (make its interest payments)? It looks bad. The firm only has 16% of what it needs to make its annual interest payments. It will be close, but the firm has almost 1.6 times what it needs to service its annual debt. No sweat. The firm has almost 6 times more income after expenses to service its debt No sweat. The firm has almost 3 times what it needs to pay its annual interest payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts