Question: In Assignment 5, we replicated the Fama-French 1993 study that showed that portfolio of stocks with high book-to-market ratios outperform portfolio of stocks with low

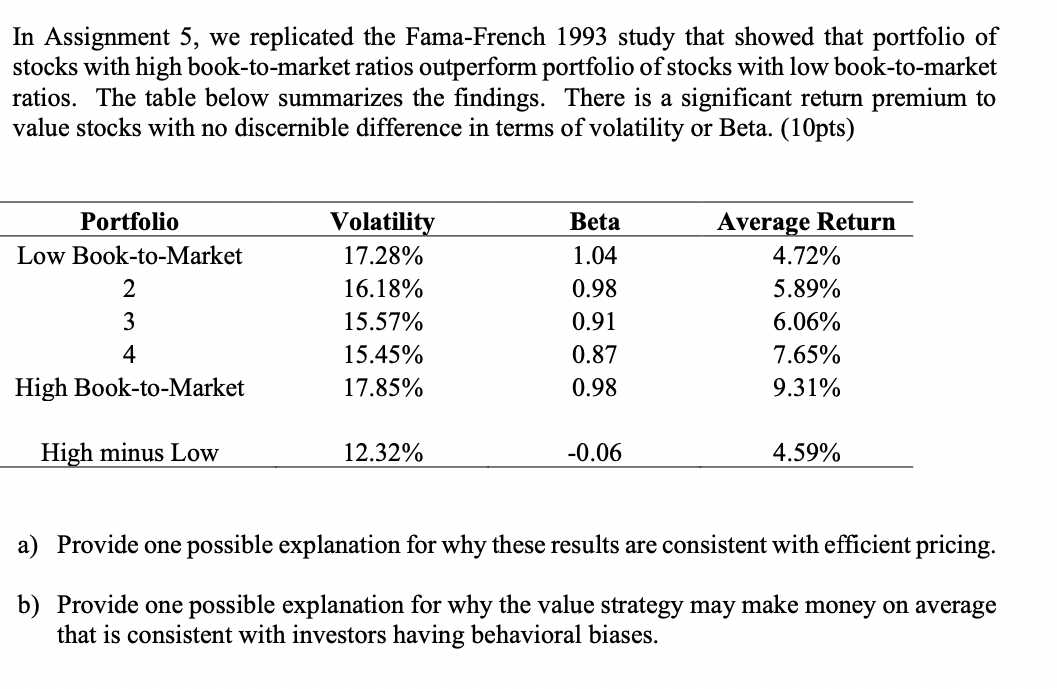

In Assignment 5, we replicated the Fama-French 1993 study that showed that portfolio of stocks with high book-to-market ratios outperform portfolio of stocks with low book-to-market ratios. The table below summarizes the findings. There is a significant return premium to value stocks with no discernible difference in terms of volatility or Beta. (10pts) a) Provide one possible explanation for why these results are consistent with efficient pricing. b) Provide one possible explanation for why the value strategy may make money on average that is consistent with investors having behavioral biases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts