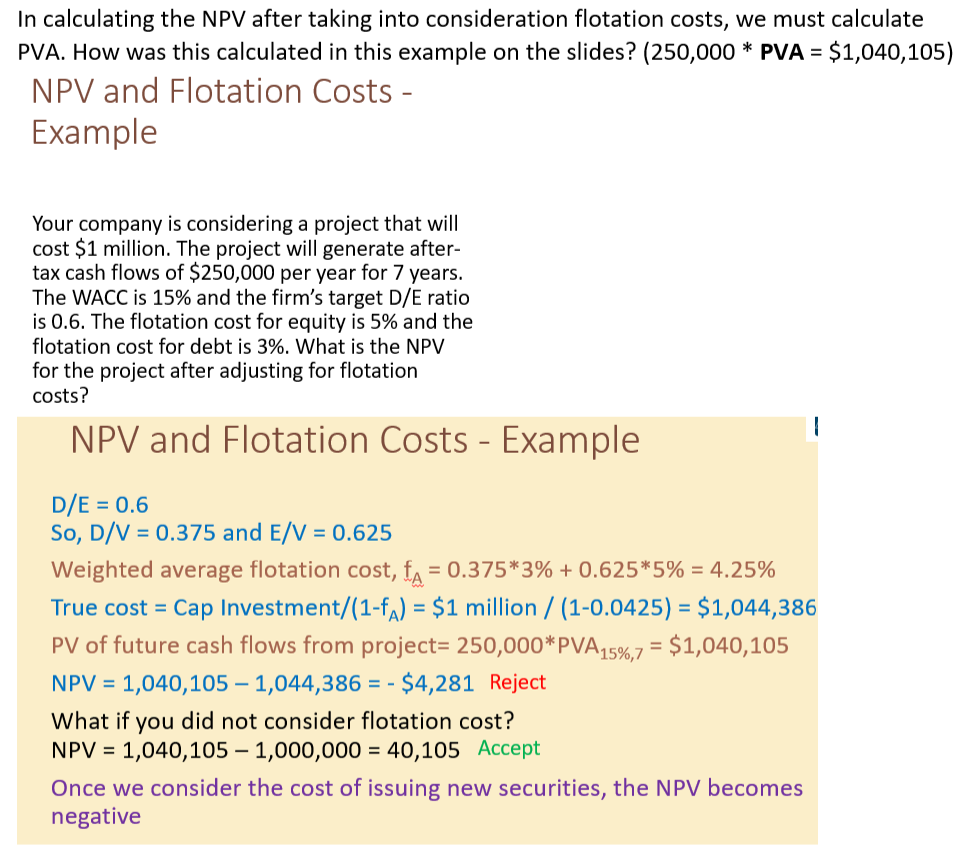

Question: In calculating the NPV after taking into consideration flotation costs, we must calculate PVA. How was this calculated in this example on the slides? (250,000PVA=$1,040,105)

In calculating the NPV after taking into consideration flotation costs, we must calculate PVA. How was this calculated in this example on the slides? (250,000PVA=$1,040,105) NPV and Flotation Costs Example Your company is considering a project that will cost $1 million. The project will generate aftertax cash flows of $250,000 per year for 7 years. The WACC is 15% and the firm's target D/E ratio is 0.6 . The flotation cost for equity is 5% and the flotation cost for debt is 3%. What is the NPV for the project after adjusting for flotation costs? NPV and Flotation Costs - Example D/E=0.6 So, D/V=0.375 and E/V=0.625 Weighted average flotation cost, fA=0.3753%+0.6255%=4.25% True cost = Cap Investment /(1fA)=$1 million /(10.0425)=$1,044,386 PV of future cash flows from project =250,000PVA15%,7=$1,040,105 NPV =1,040,1051,044,386=$4,281 Reject What if you did not consider flotation cost? NPV =1,040,1051,000,000=40,105 Accept Once we consider the cost of issuing new securities, the NPV becomes negative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts