Question: In Class Exercise ch 4 part B 8. Assume the profit margin and the payout ratio of Major Manuscripts, Inc. are constant. If sales increase

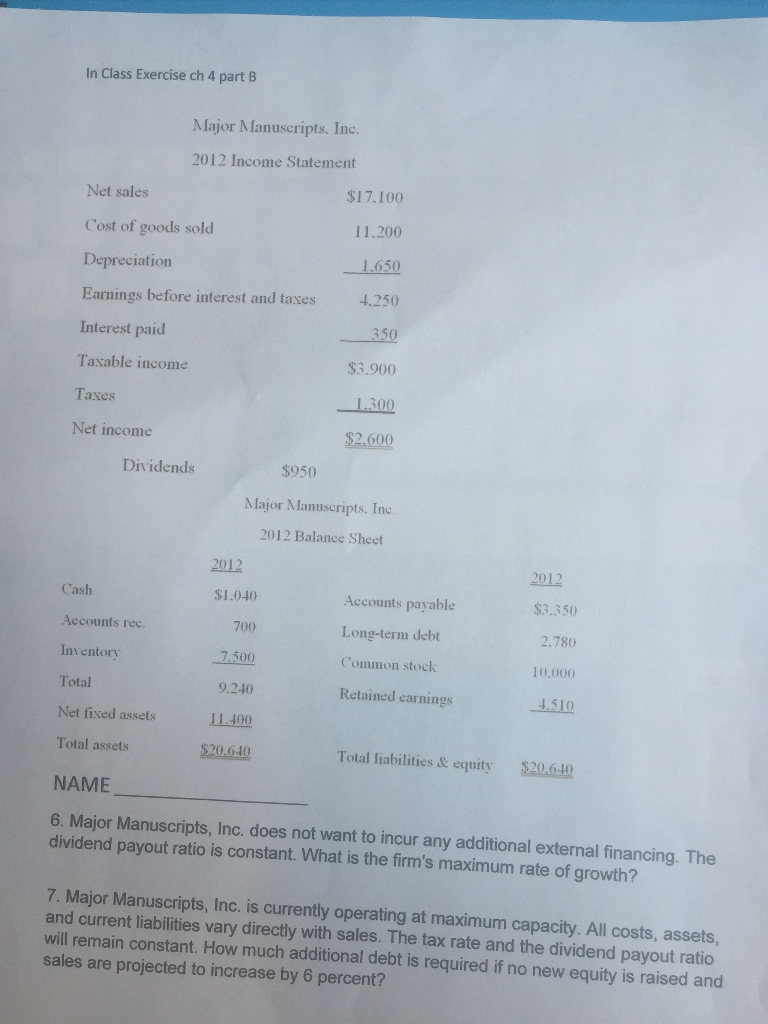

In Class Exercise ch 4 part B 8. Assume the profit margin and the payout ratio of Major Manuscripts, Inc. are constant. If sales increase by 9 percent, what is the pro forma retained earnings? 9. What is Major Manuscripts, Inc.'s retention ratio? 10. Which one of the following will increase the maximum rate of growth a corporation can achieve? A. avoidance of external equity financing B. increase in corporate tax rates C. reduction in the retention ratio D. decrease in the dividend payout ratio E. decrease in sales given a positive profit margin 11. Mumbai Inc. had sales of $10,000, profit margin of 5%, and total assets of $100,000. The company's dividend payout was 25% and its equity totaled $75,000. What is the internal growth rate? Show your calculations. 12. In #11 above, what is the sustainable growth rate? Show your calculations. End of In Class Exercise In Class Exercise ch 4 part B Major Manuscripts. Inc. 2012 Income Statement $17.100 Net sales Cost of goods sold 11.200 1.650 Depreciation Earnings before interest and taxes 4.250 350 Interest paid Taxable income $3.900 Taxes 1.300 Net income $2.600 Dividends $950 Major Manuscripts. Inc. 2012 Balance Sheet 2012 2012 Cash $1.040 $3.350 Accounts rec. 700 2.780 Accounts payable Long-term debt Common stock Retained earnings Inventory 7.500 10.000 Total 9.240 1,510 Net fixed assets 11.400 Total assets $20.640 Total liabilities & equity $20.640 NAME 6. Major Manuscripts, Inc. does not want to incur any additional external financing. The dividend payout ratio is constant. What is the firm's maximum rate of growth? 7. Major Manuscripts, Inc. is currently operating at maximum capacity. All costs, assets, and current liabilities vary directly with sales. The tax rate and the dividend payout ratio will remain constant. How much additional debt is required if no new equity is raised and sales are projected to increase by 6 percent? In Class Exercise ch 4 part B 8. Assume the profit margin and the payout ratio of Major Manuscripts, Inc. are constant. If sales increase by 9 percent, what is the pro forma retained earnings? 9. What is Major Manuscripts, Inc.'s retention ratio? 10. Which one of the following will increase the maximum rate of growth a corporation can achieve? A. avoidance of external equity financing B. increase in corporate tax rates C. reduction in the retention ratio D. decrease in the dividend payout ratio E. decrease in sales given a positive profit margin 11. Mumbai Inc. had sales of $10,000, profit margin of 5%, and total assets of $100,000. The company's dividend payout was 25% and its equity totaled $75,000. What is the internal growth rate? Show your calculations. 12. In #11 above, what is the sustainable growth rate? Show your calculations. End of In Class Exercise In Class Exercise ch 4 part B Major Manuscripts. Inc. 2012 Income Statement $17.100 Net sales Cost of goods sold 11.200 1.650 Depreciation Earnings before interest and taxes 4.250 350 Interest paid Taxable income $3.900 Taxes 1.300 Net income $2.600 Dividends $950 Major Manuscripts. Inc. 2012 Balance Sheet 2012 2012 Cash $1.040 $3.350 Accounts rec. 700 2.780 Accounts payable Long-term debt Common stock Retained earnings Inventory 7.500 10.000 Total 9.240 1,510 Net fixed assets 11.400 Total assets $20.640 Total liabilities & equity $20.640 NAME 6. Major Manuscripts, Inc. does not want to incur any additional external financing. The dividend payout ratio is constant. What is the firm's maximum rate of growth? 7. Major Manuscripts, Inc. is currently operating at maximum capacity. All costs, assets, and current liabilities vary directly with sales. The tax rate and the dividend payout ratio will remain constant. How much additional debt is required if no new equity is raised and sales are projected to increase by 6 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts