Question: In Class Practice Example Periodicinventory System FIFO Practice Example Concept: The cost of the earliest purchases that make up cost of goods available for sale

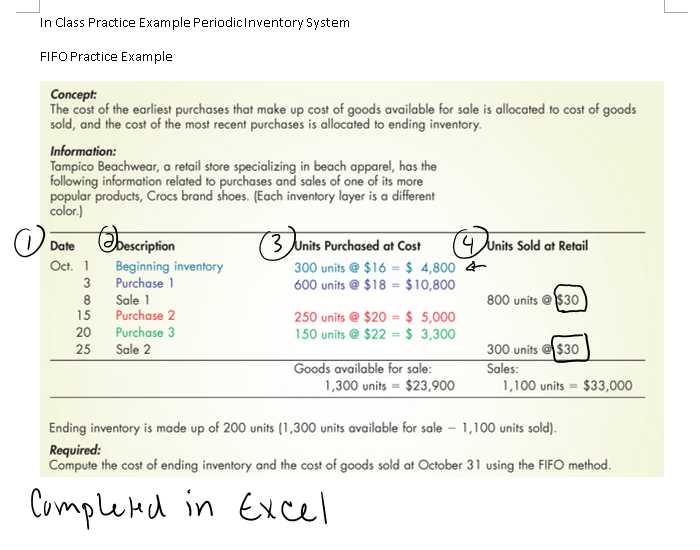

In Class Practice Example Periodicinventory System FIFO Practice Example Concept: The cost of the earliest purchases that make up cost of goods available for sale is allocated to cost of goods sold, and the cost of the most recent purchases is allocated to ending inventory. Information: Tampico Beachwear, a retail store specializing in beach apparel, has the following information related to purchases and sales of one of its more popular products, Crocs brand shoes. (Each inventory layer is a different color.) 0 units Sold at Retail Date Description Oct. 1 Beginning inventory 3 Purchase 1 8 Sale 1 15 Purchase 2 20 Purchase 3 25 Sale 2 3 Units Purchased at Cost 300 units @ $16 - $ 4,800 + 600 units @ $18 = $10,800 250 units @ $20 = $ 5,000 150 units @ $22 = $ 3,300 800 units @ $30 Goods available for sale: 1,300 units = $23,900 300 units @ $30 Sales: 1,100 units = $33,000 Ending inventory is made up of 200 units (1,300 units available for sale - 1,100 units sold). Required: Compute the cost of ending inventory and the cost of goods sold at October 31 using the FIFO method. Completed in Excel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts