Question: In class, we discussed the differences between a contribution income statement versus the traditional approach (absorption which is GAAP). There is no difference in operating

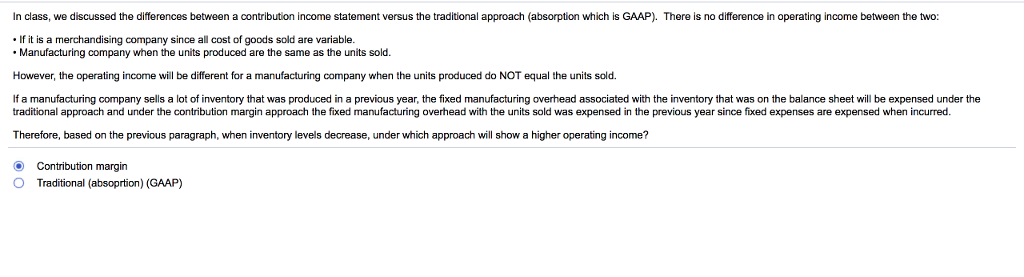

In class, we discussed the differences between a contribution income statement versus the traditional approach (absorption which is GAAP). There is no difference in operating income between the two: If it is a merchandising company since all cost of goods sold are variable Manufacturing company when the units produced are the same as the units sold. However, the operating income will be different for a manufacturing company when the units produced do NOT equal the units sold. If a manufacturing company sells a lot of inventory that was produced in a previous year, the fixed manufacturing overhead associated with the inventory that was on the balance sheet will be expensed under the traditional approach and under the contribution margin approach the fixed manufacturing overhead with the units sold was expensed in the previous year since fixed expenses are expensed when incurred. Therefore, based on the previous paragraph, when inventory levels decrease, under which approach will show a higher operating income? Contribution margin Traditional (absoprtion) (GAAP) O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts