Question: In comparing the canceled checks on the bank statement with the entries in the accounting records, it is found that check number 4239 for November's

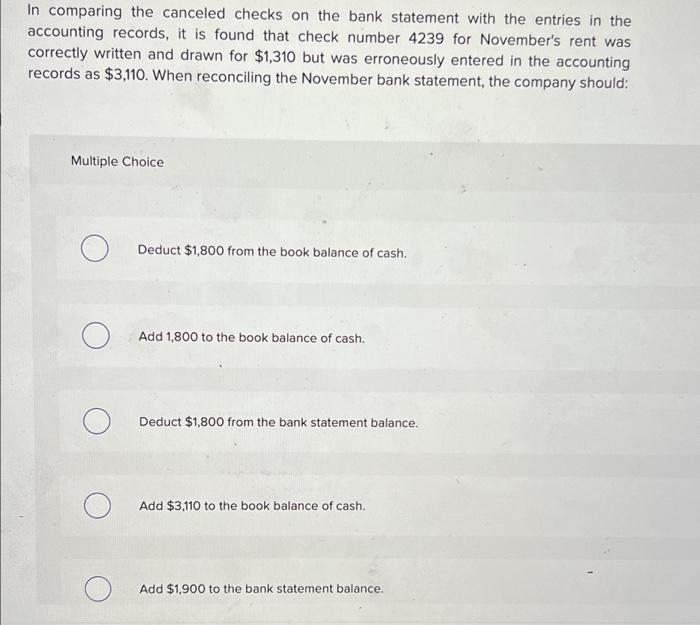

In comparing the canceled checks on the bank statement with the entries in the accounting records, it is found that check number 4239 for November's rent was correctly written and drawn for $1,310 but was erroneously entered in the accounting records as $3,110. When reconciling the November bank statement, the company should: Multiple Choice O O O Deduct $1,800 from the book balance of cash. Add 1,800 to the book balance of cash. Deduct $1,800 from the bank statement balance. $147 Add $3,110 to the book balance of cash. Add $1,900 to the bank statement balance.

In comparing the canceled checks on the bank statement with the entries in the accounting records, it is found that check number 4239 for November's rent was correctly written and drawn for $1,310 but was erroneously entered in the accounting records as $3,110. When reconciling the November bank statement, the company should: Multiple Choice Deduct $1,800 from the book balance of cash. Add 1,800 to the book balance of cash. Deduct $1,800 from the bank statement balance. Add $3,110 to the book balance of cash. Add $1,900 to the bank statement balance

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock