Question: In December 2 0 2 3 , Northern Pack Pros Corporation was examining two investment proposals for the year 2 0 2 5 . One

In December Northern Pack Pros Corporation was examining two investment proposals for the year One proposal was to replace a packaging machine that was causing considerable problems on the assembly line. The other proposal was to install a series of new machines that would greatly improve the process of plastic filmbubble packaging. This is an area that is expanding rapidly and one in which the firm has previously not participated to any extent.

COMPANY BACKGROUND

Northern Park Pros started in the late s by purchasing surplus government cartons mainly from Detroit, Milwaukee and Chicago and reselling them to the business community in Marquette. Within a few years, it became a major distributor and supplier of corrugated cartons, paper boxes, paper, and miscellaneous supply items in the Upper Peninsula. As it grew, equipment for cutting, wrapping and processing paper and boxes were purchased and the company became a manufacturer of corrugated cartons, which formally it purchased and then distributed. By early plastics began to substitute for paper bags and cartons. The company entered this new area by selling plastic films and bags as well as machines for packaging items into plastic bags and film. It further expanded by putting a plastic coating onto the paper boards and then diecutting them to various sizes and shapes. Added to these activities was the selling of printing equipment, cameras and plates for printing and additional diecutting and coating items. Showrooms were added to exhibit the various types of machinery available to manufacturers who wished to display their products in clear packages. Thus, the company today is a supplier both of machinery and supplies to those manufacturers who want to package their own merchandise and of packages for manufacturers who prefer to sublet this part of the production process.

INVESTMENT ALTERNATIVES

a Replacement of old equipment The first investment alternative, Project to consider is the replacement of the packaging machine. The machine currently being used was purchased years earlier for $ At that time, the firm decided to depreciate the machine on a straightline basis over years. There was no anticipated salvage value, though it would now be sold for a salvage value of $ At the present time, the old machine is contributing $ annually to revenues while the operating costs have been running $ per year. If the new machine for the replacement was purchased now January it would cost the company $ with installation and modification costs of $ The new machine would have a depreciable life of years. The depreciation method would be Year MACRs see MACRS table, Exhibit below It is estimated that the annual revenue would be $ with annual operating costs of $ For the investment analysis, a tax rate would be appropriate

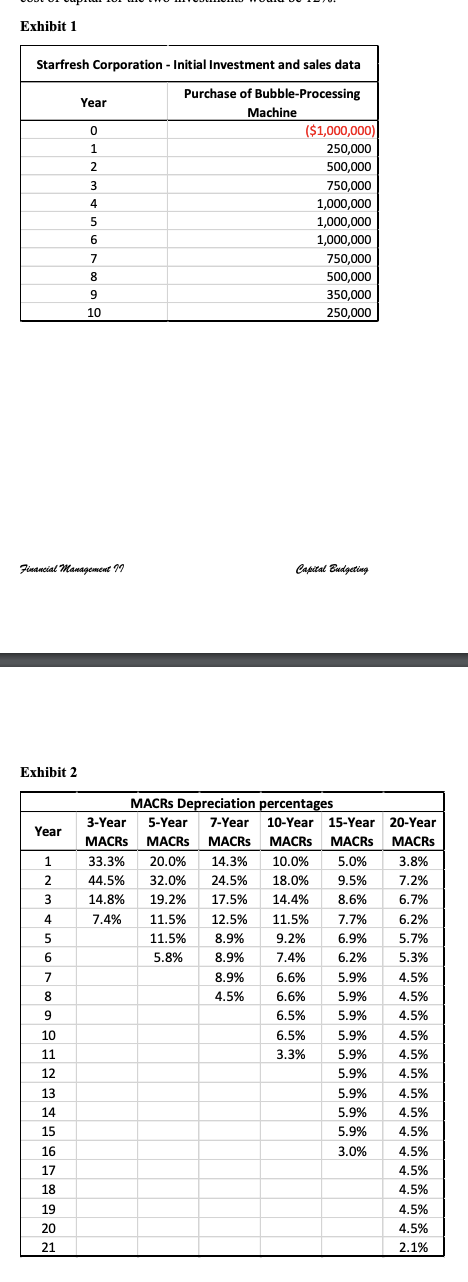

b New project The second investment Project is a series of new machines that would greatly enhance the firms ability to enter the bubblepackaging business. The cost of the new machines would be $ with additional, transportation, installation and modification costs of $ This investment the installed cost would have a depreciable life of years, using the Year MACRs depreciation method. It is anticipated that the operating costs, excluding depreciation, would run of sales. In addition to the initial outlay of $ million above Northern Pack Pros anticipates that it would have to make a workingcapital investment. Analysis has resulted in the estimate that a proper workingcapital requirement would be of sales. As with the other investment, the tax rate of the investment analysis would be The revenue flows anticipated for this product are shown in Exhibit below. The new machine can be sold for $ at the end of the project. The CEO of Northern Pack Pros is interested in seeing a chart on the net cash flow development of both alternatives the replacement investment and the newequipment investment. In addition, the CEO is interested in seeing what the net present value, the internal rate of return and the payback would be for each investment alternative. For the investment analysis, the finance department expects that the weighted cost of capital for the two investments would be

Calculate the incremental cash flows associated with the replacement alternative.

Determine the incremental cash flows associated with the proposed new project.

Determine the Net Present Value NPV and the Internal rate of Return IRR of the replacement project

Determine the NPV and IRR of the new project.

Determine the Payback period of each project.

What is the highest cost of capital that the Northern Pack Pros could have and still accept the best alternative project ie replacement or new project

Make a brief recommendation to accept or reject the replacement or new project and justify answ

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock