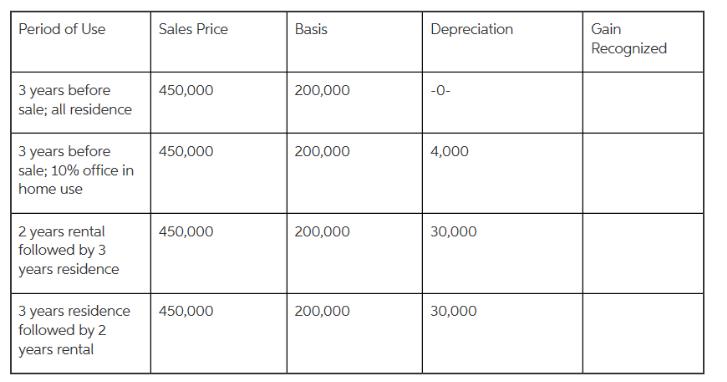

Question: In each case, the property has been used as a principal residence for the period described, and subject to the facts as described. The basis

In each case, the property has been used as a principal residence for the period described, and subject to the facts as described. The basis shown is AFTER the depreciation.

Period of Use Sales Price Basis Depreciation Gain Recognized 3 years before sale; all residence 450,000 200,000 -0- 3 years before sale; 10% office in 450,000 200,000 4,000 home use 2 years rental followed by 3 years residence 450,000 200,000 30,000 3 years residence followed by 2 450,000 200,000 30,000 years rental

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Basis after Exclusion recognised Sale price depreciation 200000 Period of use R... View full answer

Get step-by-step solutions from verified subject matter experts