Question: In each part below, provide an expression for the value at 1/1/2010 of the payments described. Your expression may incorporate annuity symbols and/or other compound

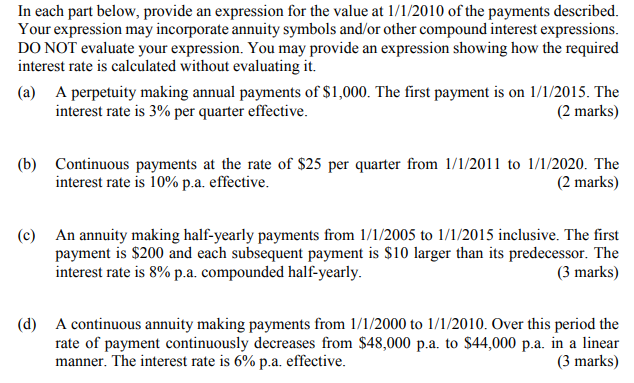

In each part below, provide an expression for the value at 1/1/2010 of the payments described. Your expression may incorporate annuity symbols and/or other compound interest expressions. DO NOT evaluate your expression. You may provide an expression showing how the required interest rate is calculated without evaluating it. (a) A perpetuity making annual payments of $1,000. The first payment is on 1/1/2015. The interest rate is 3% per quarter effective. (2 marks) (b) Continuous payments at the rate of $25 per quarter from 1/1/2011 to 1/1/2020. The interest rate is 10% p.a. effective. (2 marks) (c) An annuity making half-yearly payments from 1/1/2005 to 1/1/2015 inclusive. The first payment is $200 and each subsequent payment is $10 larger than its predecessor. The interest rate is 8% p.a. compounded half-yearly. (3 marks) (d) A continuous annuity making payments from 1/1/2000 to 1/1/2010. Over this period the rate of payment continuously decreases from $48,000 p.a. to $44,000 p.a. in a linear manner. The interest rate is 6% p.a. effective. (3 marks) In each part below, provide an expression for the value at 1/1/2010 of the payments described. Your expression may incorporate annuity symbols and/or other compound interest expressions. DO NOT evaluate your expression. You may provide an expression showing how the required interest rate is calculated without evaluating it. (a) A perpetuity making annual payments of $1,000. The first payment is on 1/1/2015. The interest rate is 3% per quarter effective. (2 marks) (b) Continuous payments at the rate of $25 per quarter from 1/1/2011 to 1/1/2020. The interest rate is 10% p.a. effective. (2 marks) (c) An annuity making half-yearly payments from 1/1/2005 to 1/1/2015 inclusive. The first payment is $200 and each subsequent payment is $10 larger than its predecessor. The interest rate is 8% p.a. compounded half-yearly. (3 marks) (d) A continuous annuity making payments from 1/1/2000 to 1/1/2010. Over this period the rate of payment continuously decreases from $48,000 p.a. to $44,000 p.a. in a linear manner. The interest rate is 6% p.a. effective

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts