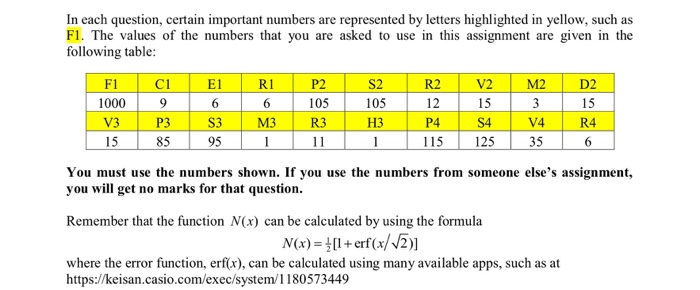

Question: In each question, certain important numbers are represented by letters highlighted in yellow, such as F1. The values of the numbers that you are asked

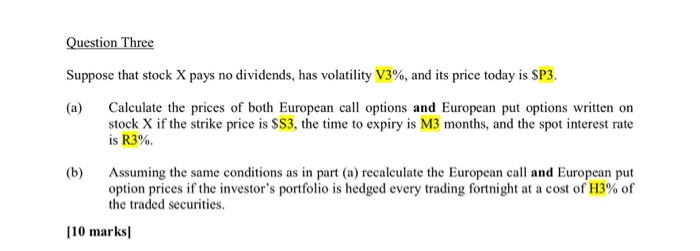

In each question, certain important numbers are represented by letters highlighted in yellow, such as F1. The values of the numbers that you are asked to use in this assignment are given in the following table: Fici E1R1 P2 S2 R2 V2 M2 D2 1000 9 6 6 6 105 105 12 153 15 V3 P3 S3 M3 R3 P4 V4 R4 15 85951 111 115 125356 H3 S4 You must use the numbers shown. If you use the numbers from someone else's assignment, you will get no marks for that question. Remember that the function N(x) can be calculated by using the formula N(x) = { []+erf(x/V2)] where the error function, erf(x), can be calculated using many available apps, such as at https://keisan.casio.com/exec/system/1180573449 Question Three Suppose that stock X pays no dividends, has volatility V3%, and its price today is SP3 (a) Calculate the prices of both European call options and European put options written on stock X if the strike price is $S3, the time to expiry is M3 months, and the spot interest rate is R3% (b) Assuming the same conditions as in part (a) recalculate the European call and European put option prices if the investor's portfolio is hedged every trading fortnight at a cost of H3% of the traded securities. [10 marks In each question, certain important numbers are represented by letters highlighted in yellow, such as F1. The values of the numbers that you are asked to use in this assignment are given in the following table: Fici E1R1 P2 S2 R2 V2 M2 D2 1000 9 6 6 6 105 105 12 153 15 V3 P3 S3 M3 R3 P4 V4 R4 15 85951 111 115 125356 H3 S4 You must use the numbers shown. If you use the numbers from someone else's assignment, you will get no marks for that question. Remember that the function N(x) can be calculated by using the formula N(x) = { []+erf(x/V2)] where the error function, erf(x), can be calculated using many available apps, such as at https://keisan.casio.com/exec/system/1180573449 Question Three Suppose that stock X pays no dividends, has volatility V3%, and its price today is SP3 (a) Calculate the prices of both European call options and European put options written on stock X if the strike price is $S3, the time to expiry is M3 months, and the spot interest rate is R3% (b) Assuming the same conditions as in part (a) recalculate the European call and European put option prices if the investor's portfolio is hedged every trading fortnight at a cost of H3% of the traded securities. [10 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts