Question: In each separate situation, show how bonds payable is reported in the long-term liabilities section of the December 31 balance sheet. (Amounts to be deducted

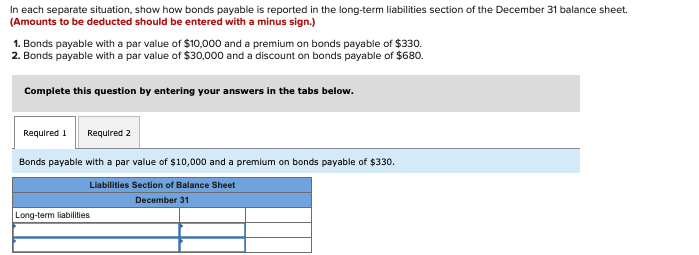

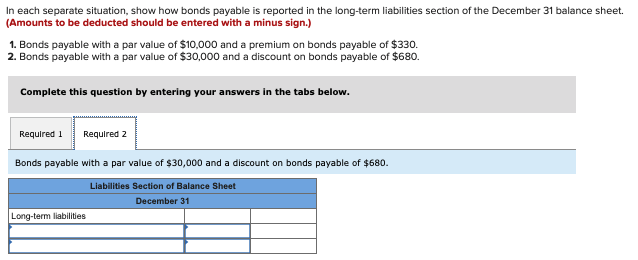

In each separate situation, show how bonds payable is reported in the long-term liabilities section of the December 31 balance sheet. (Amounts to be deducted should be entered with a minus sign.) 1. Bonds payable with a par value of $10,000 and a premium on bonds payable of $330. 2. Bonds payable with a par value of $30,000 and a discount on bonds payable of $680. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Bonds payable with a par value of $10,000 and a premium on bonds payable of $330. Liabilities Section of Balance Sheet December 31 Long-term liabilities In each separate situation, show how bonds payable is reported in the long-term liabilities section of the December 31 balance sheet. (Amounts to be deducted should be entered with a minus sign.) 1. Bonds payable with a par value of $10,000 and a premium on bonds payable of $330. 2. Bonds payable with a par value of $30,000 and a discount on bonds payable of $680. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Bonds payable with a par value of $30,000 and a discount on bonds payable of $680. Liabilities Section of Balance Sheet December 31 Long-term liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts