Question: In Example 9.1, we calculated the gains and losses from price controls on natural gas and found that there was a deadweight loss of $5.68

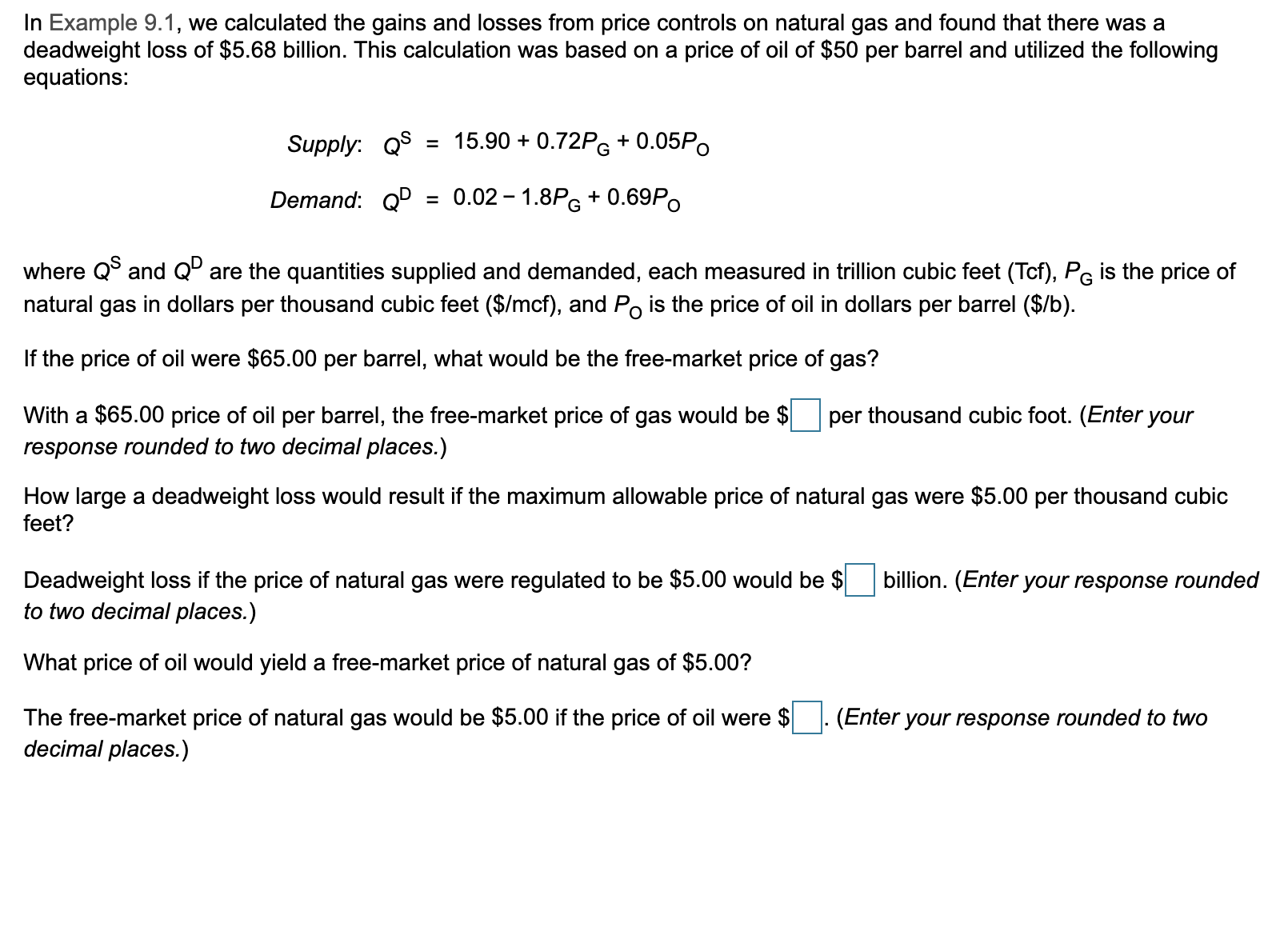

In Example 9.1, we calculated the gains and losses from price controls on natural gas and found that there was a deadweight loss of $5.68 billion. This calculation was based on a price of oil of $50 per barrel and utilized the following equations: Supply: Q3 15.90 + 0.72P'3 + 0.05PO 0.02 -1.8PG + 0.69PO Demand: QD where Q3 and OD are the quantities supplied and demanded. each measured in trillion cubic feet (ch), PG is the price of natural gas in dollars per thousand cubic feet ($lmcf), and PO is the price of oil in dollars per barrel ($lb). If the price of oil were $65.00 per barrel, what would be the free-market price of gas? With a $65.00 price of oil per barrel, the free-market price of gas would be $D per thousand cubic foot. (Enter your response rounded to two decimal places.) How large a deadweight loss would result if the maximum allowable price of natural gas were $5.00 per thousand cubic feet? Deadweight loss if the price of natural gas were regulated to be $5.00 would be $E| billion. (Enter your response rounded to two decimal places.) What price of oil would yield a free-market price of natural gas of $5.00? The free-market price of natural gas would be $5.00 if the price of oil were $|:|. (Enter your response rounded to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts